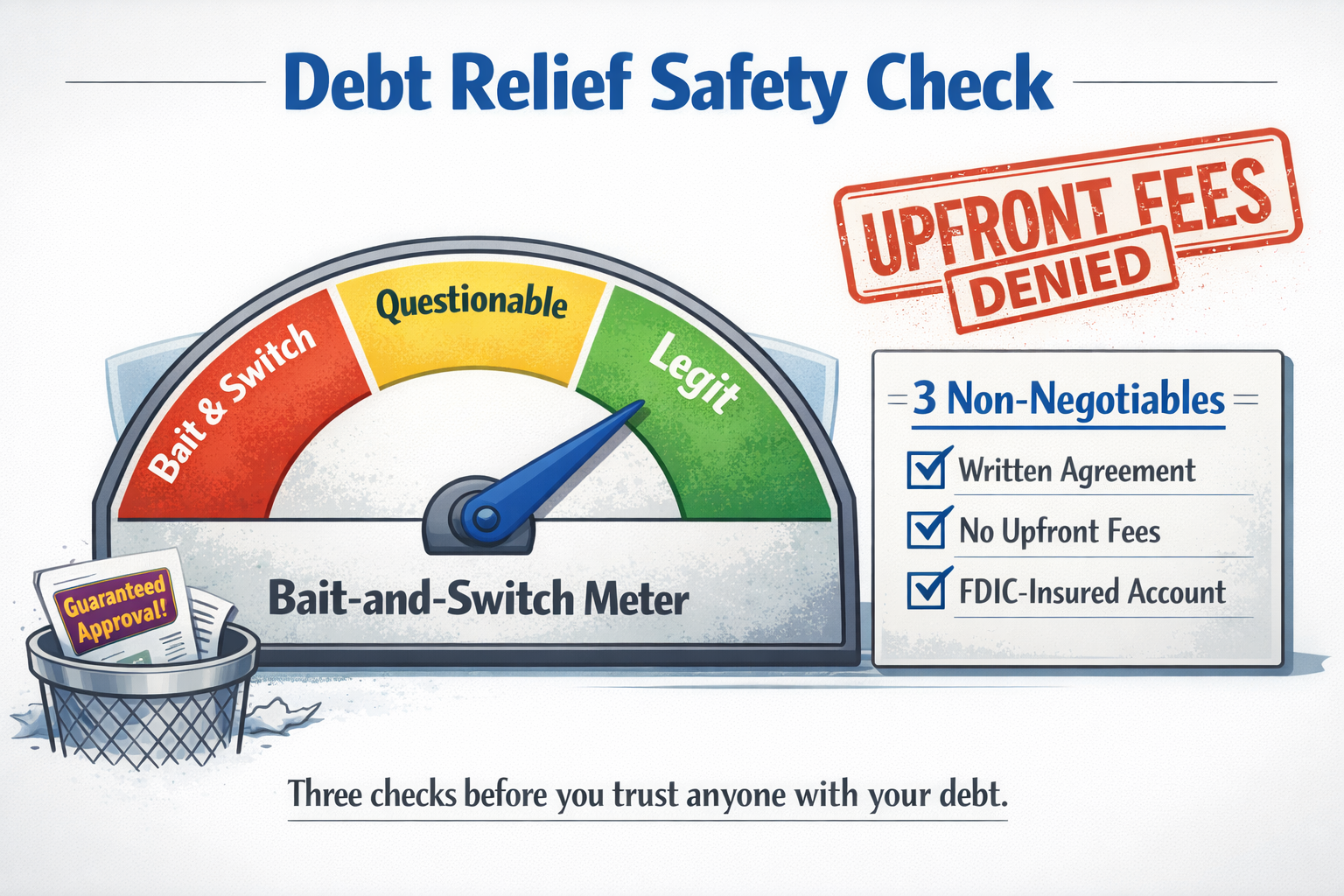

“Debt settlement is a scam” made sense 15 years ago. Today, it’s an oversimplification. Learn how the 2010 FTC rules changed the industry, three non-negotiables for identifying legitimate companies, and what really happens to your credit.

Tag: Credit Score Impact

With credit card APRs nearing 25% and relief from the Fed nowhere in sight, families are facing painful choices. This article breaks down what today’s interest rates mean for your wallet, and the debt settlement strategies that might actually help.

Debt settlement and consumer credit counseling are two popular approaches for managing financial distress, but each comes with its own advantages and challenges. While debt settlement can reduce the amount you owe, it may impact your credit score. Consumer credit counseling, on the other hand, focuses on debt management and financial education without reducing the principal owed. Explore the differences between these methods to find the right fit for your financial needs.

Recent Posts

Tags

Big Beautiful Bill

Budgeting

Consumer Protection

Consumer Spending

Credit Card Debt

Credit Counseling

Credit Impact

Credit Score Impact

Debt-to-Income Ratio

Debt Management

Debt Management Options

Debt Reduction Strategies

Debt Relief

Debt Relief Options

Debt Relief Strategies

Debt Settlement

Debt Settlement Eligibility

Debt Settlement Process

Debt Strategies

Economic Policy

Federal Student Aid

Federal Student Loans

Financial Empowerment

Financial Freedom

Financial Hardship Assistance

Financial Hardship Solutions

Financial Literacy

Financial Planning

Financial Recovery

Financial Stress

Higher Education

Household Budgeting

Household Debt

Income-Driven Repayment

Inflation

Interest Rates

Loan Repayment

Minimum Payments

Nana Tilly

Personal Finance

Relief Strategies

Shady Pay

Student Loan Forgiveness

Student Loans

U.S. Economy

All Services

- Awards & Recognition

- Client Success & Debt Relief Outcomes

- Company Updates

- Consumer Alerts

- Consumer Protection & Debt Relief

- Consumer RIghts & Protections

- Credit & Debt Management

- Credit Impact

- Debt Management Strategies

- Debt Relief & Economic Policy

- Debt Relief Insights

- Debt Settlement Insights

- Economic Policy & Personal Finance

- Events

- Financial Education & Awareness

- Student Loan News

- Student Loans & Financial Aid