Find answers to common questions about our federal student loan relief services and how we can help you regain control of your financial future.

Federal Student Loan FAQ

- Flexible Repayment Options

- Expert Guidance

- PSLF & IDR Programs

Navigating federal student loan options can feel overwhelming. At Relief Strategies, we specialize in helping borrowers explore available relief programs, understand eligibility, and take advantage of solutions designed to reduce financial stress. Below, you’ll find answers to frequently asked questions about repayment plans, loan forgiveness, and more. Need more details? Don’t hesitate to reach out to our team today!

Key Program Highlights

Flexible Payment Options

Choose a repayment plan that aligns with your budget and long-term financial goals.

Expert Program Guidance

Get personalized help understanding repayment and forgiveness options.

PSLF & IDR Programs

Explore Public Service Loan Forgiveness and Income-Driven Repayment for lasting solutions.

Program Basics

-

What is the Federal Student Loan Program?

Our Federal Student Loan Program is designed to help borrowers manage and potentially reduce their federal student loan debt. Through this program, our partner works with you to explore options such as income-driven repayment plans, loan consolidation, forgiveness programs, and more to make your loan repayment more manageable.

-

Who qualifies for the Federal Student Loan Program?

This program is open to individuals with federal student loans, including Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. Eligibility may vary based on loan type, current employment, and financial hardship status, so our partner can assist you in determining the best options for your unique situation.

-

What types of loans are covered under the program?

This program is specifically for federal student loans, including Direct Subsidized and Unsubsidized Loans, PLUS Loans, Perkins Loans, and FFEL loans. Private student loans are not eligible for this program.

-

What is student loan forgiveness, and do I qualify?

Federal student loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, offer debt relief to borrowers working in eligible fields. Requirements vary, but generally, PSLF is available to those working for qualifying public or non-profit employers. Our partner can review your eligibility for these and other forgiveness programs.

-

How can I determine which repayment option is best for me?

Choosing the best repayment plan depends on various factors, including your income, family size, and long-term financial goals. Our partner provides a free consultation to help you understand your options and find a plan tailored to your needs.

-

Can I handle the federal student loan process on my own?

Yes, you can manage the process independently through the Department of Education or FAFSA, but it can be time-consuming and complex, especially if you're unfamiliar with the programs and eligibility requirements. You'll also need to remember to recertify your income and family size annually to maintain eligibility. Missing deadlines could result in losing program benefits and may require restarting the process. Our partner offers guidance to simplify this process, ensuring timely submissions and ongoing support.

Mon-Fri 8AM-5PM PST

(888) 870-7922

Loan Repayment and Consolidation Options

-

Will this program impact my credit score?

Entering an income-driven repayment plan or consolidating loans typically does not directly impact your credit score. However, consistently making reduced payments based on your income can improve your overall financial health, potentially benefiting your credit over time.

-

Can I consolidate my federal student loans?

Yes, eligible federal loans can be consolidated into a single loan through a Direct Consolidation Loan. This simplifies payments and may open the door to additional repayment options, including income-driven plans. Our partner can help you decide if consolidation aligns with your financial goals.

-

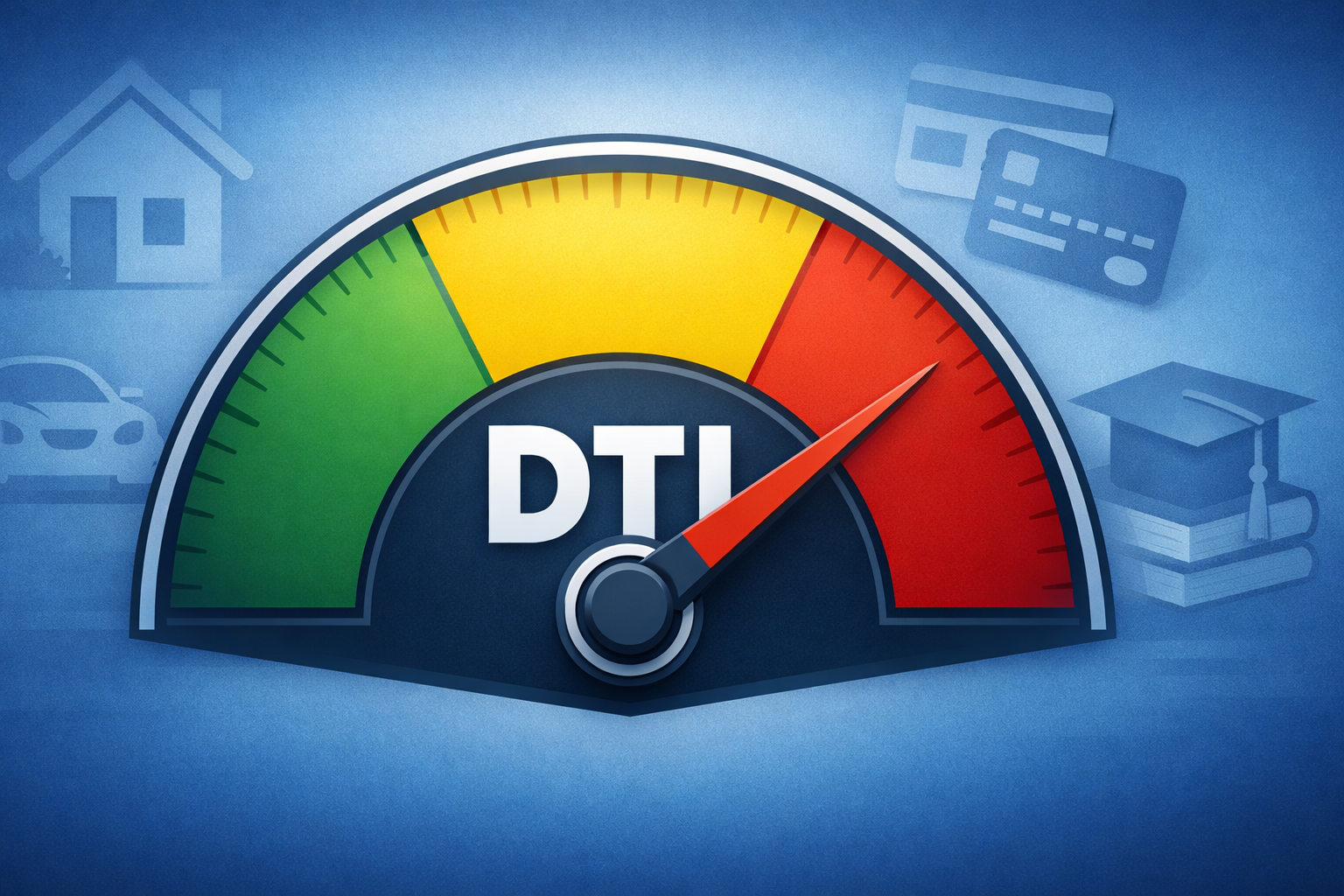

How does an income-driven repayment (IDR) plan work?

An income-driven repayment plan adjusts your monthly payment based on income and family size. Payments under IDR plans can be as low as $0 if your income is below a certain threshold, and any remaining balance after 20-25 years of qualifying payments may be forgiven. Our partner can assist you in determining which IDR plan suits your needs.

-

Will my monthly payment be lower with an income-driven plan?

For many borrowers, an income-driven repayment plan reduces monthly payments, especially if income is low or family size is large. Our partner can help calculate the potential payment amount under different plans to find the one that works best for your financial situation.

Enrollment and Fees

-

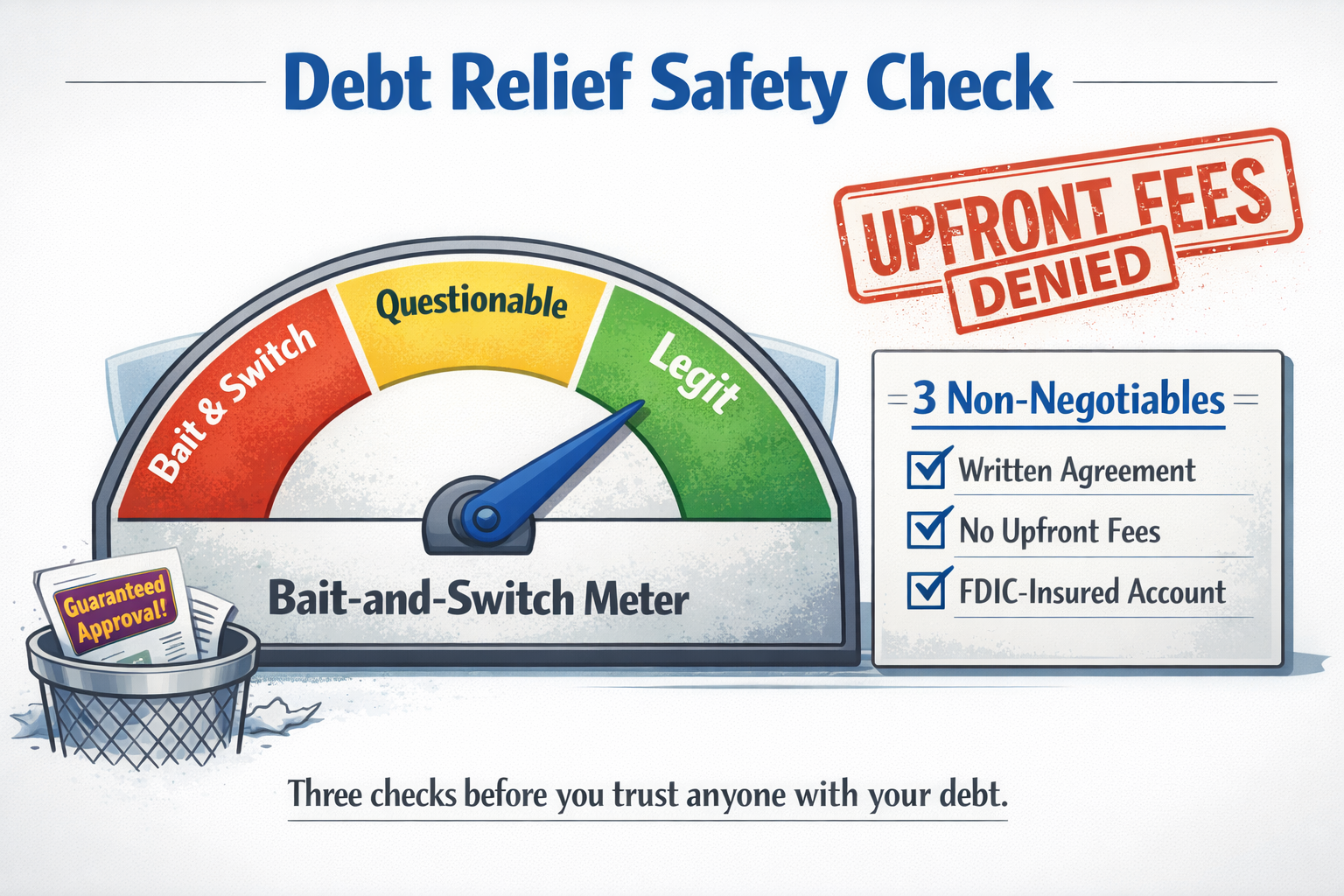

Are there any fees for this program?

The federal government provides these programs without cost, but if you prefer assistance in navigating, understanding, and enrolling in a suitable plan, our partner offers this support. All fees for assistance are clearly explained and only apply if you choose to use this added service.

-

How long does it take to enroll in a new repayment plan or consolidation?

Enrollment times can vary based on individual circumstances and loan servicer processing times. Typically, applying for a new repayment plan or consolidation may take a few weeks, though our partner will keep you informed at each stage of the process.

Payment Management and Financial Challenges

-

Can I still make extra payments if I’m on an income-driven plan?

Yes, you can make extra payments at any time without penalty. Doing so can reduce your loan principal and lower overall interest costs. If you’re able to afford extra payments, it’s a great way to pay off your loans faster and decrease the total amount paid over the life of the loan.

-

What happens if I miss a payment under the new repayment plan?

If you miss a payment, your loan could return to a standard repayment plan, and unpaid interest may capitalize. However, many repayment plans have options for temporary deferment or forbearance in cases of financial hardship. Our partner can provide guidance if you anticipate payment difficulties.

-

Are there any tax implications with loan forgiveness?

Loan balances forgiven through income-driven repayment plans may be considered taxable income. However, some forgiveness programs, like Public Service Loan Forgiveness, are currently tax-free. We recommend consulting a tax advisor for information tailored to your circumstances.

-

What if I’ve defaulted on my federal student loans?

If you are in default, there may be options to rehabilitate or consolidate the loans to bring them back into good standing. Our partner can guide you through these processes and help you regain control of your loans and financial future.

-

Will my loans still accrue interest under a new repayment plan?

Yes, interest continues to accrue on federal student loans. However, certain income-driven repayment plans may cover part of the accruing interest, especially on subsidized loans, potentially reducing the impact of interest over time.

Real Results, Real Impact

Success Stories That Inspire

Izzy helped me and after discussing how to get me get out of debt, I felt so much better! Thanks for the service!

Jennifer B

I can’t believe just how much this one phone call has taken off my shoulders. I dug myself into a hole with the payday loan that was going to cost me thousands and thousands of dollars for just a $4000 loan. Izzy has been a lifesaver trying to show me a better way. And I am so grateful and thankful that she was there to help me today She was knowledgeable and friendly and patient with my computer skills and I really appreciate it

Kimberly G

Izzy was very kind and patient. She explained the process in a manner that I was able to understand. Even after the entire process, I am still able to get in contact with Izzy and she will respond in a timely manner. I definitely recommend her to others. 🙂

Rosita C

My representative was Frank G. Amazing experience! I had talked to other agencies that deal with my debt challenge, never felt comfortable until I contacted Relief Strategies. I was extremely lucky to find Frank on the phone. He was understanding, considerate and compassionate. Once we talked and he gave me the facts and opinions i immediately signed for their services! He is great to work with. Give him a call

Frank B

Izzy, you are AMAZING! Your ability to help me see the BIG picture was eye opening and alarming. I was trapped, a POW to debt and I didn't even know. I praise God for you and your team of soldiers, fighting for me. Thank you 😊

Gloria G

Izzy was very personable and knowledgeable about the program and all that it offers. She made it a less stressful experience.

Sonja W

Ready to take the next step?

Our team is here to guide you through every stage of the federal student loan relief process. Contact us today to learn more or schedule a consultation to discuss your options.

Explore More on Debt Relief

Stay informed with our latest articles and resources.