Get answers to your most common questions about consolidating debt and simplifying your financial future.

Debt Consolidation FAQ

- Easy Qualification

- Trusted Solutions

- Fast Relief

Debt settlement is an effective way to address overwhelming financial challenges. At Relief Strategies, we help you navigate this process with expert guidance, providing answers to your most pressing questions. Below, you’ll find everything you need to know about how debt settlement works, its benefits, and what you can expect from our program. Need more details? Feel free to reach out to us!

Key Program Highlights

Debt Reduction

Negotiate reduced balances to make your debt more manageable.

Professional Guidance

Work with trusted professionals every step of the way.

Tailored Plans

Receive customized solutions based on your unique financial situation.

General Debt Consolidation Questions

-

What is debt consolidation?

Debt consolidation is the process of combining multiple debts into a single loan with a structured repayment plan, often with a lower interest rate to simplify payments.

-

How does debt consolidation work?

It involves taking out a new loan to pay off existing debts, leaving you with one monthly payment instead of multiple obligations to different creditors.

-

How is debt consolidation different from debt settlement?

Debt consolidation restructures your debt into one manageable loan, whereas debt settlement negotiates with creditors to reduce the total amount owed.

-

Does debt consolidation reduce the total amount of debt I owe?

No, debt consolidation does not reduce your total balance. Instead, it restructures payments, often lowering interest rates and monthly payments to make repayment more manageable.

Costs & Payment

-

What are the costs associated with debt consolidation?

Costs may include loan origination fees, interest charges, and potential balance transfer fees, depending on the lender and loan terms.

-

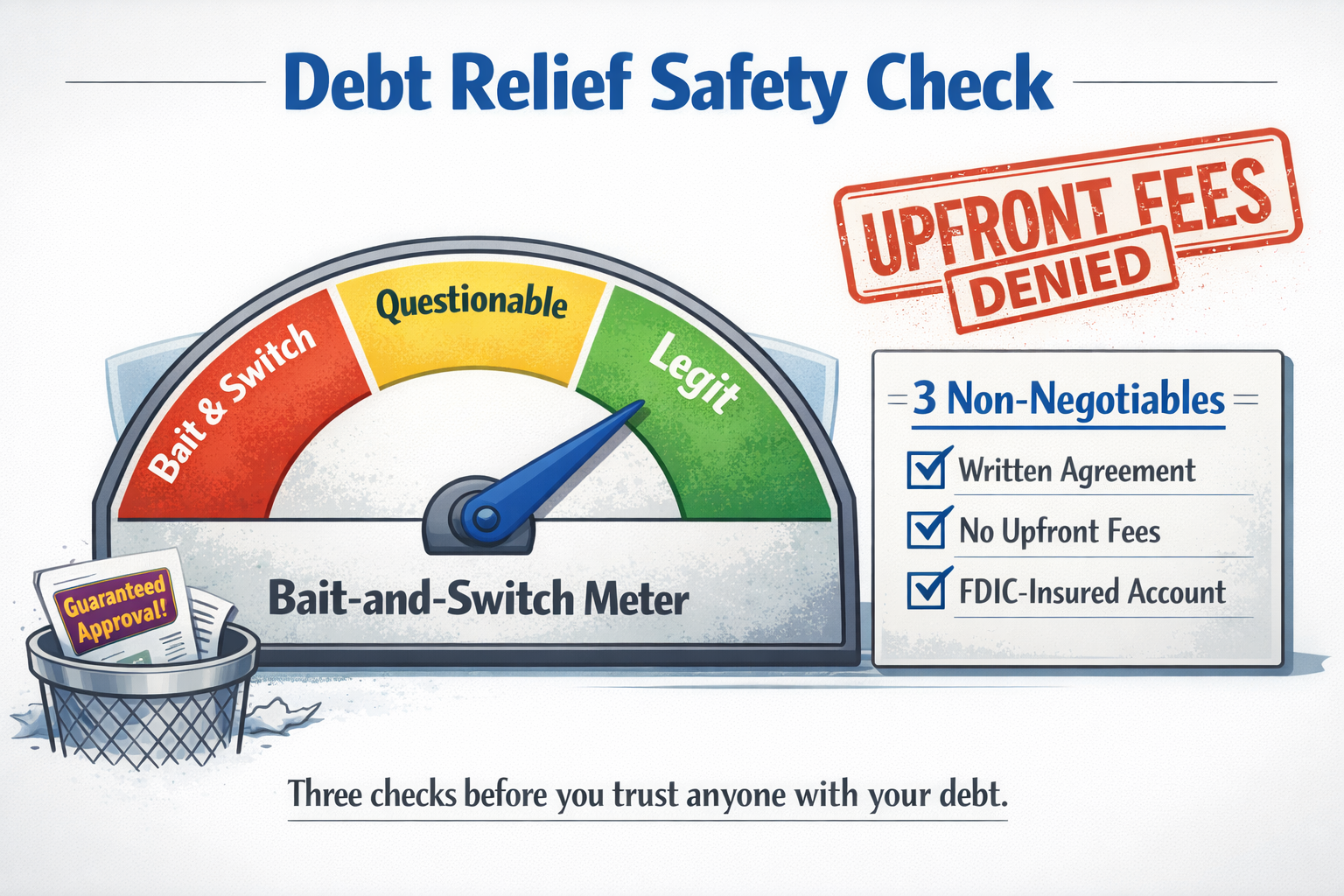

Are there any hidden fees?

No, all fees should be disclosed upfront before accepting a consolidation loan. It’s important to review the terms carefully.

-

What happens if I miss a payment on my consolidation loan?

Missing payments can result in late fees, increased interest rates, and negative impacts on your credit score. Some lenders may offer hardship assistance programs.

Mon-Fri 8AM-5PM PST

(888) 870-7922

Eligibility & Enrollment

-

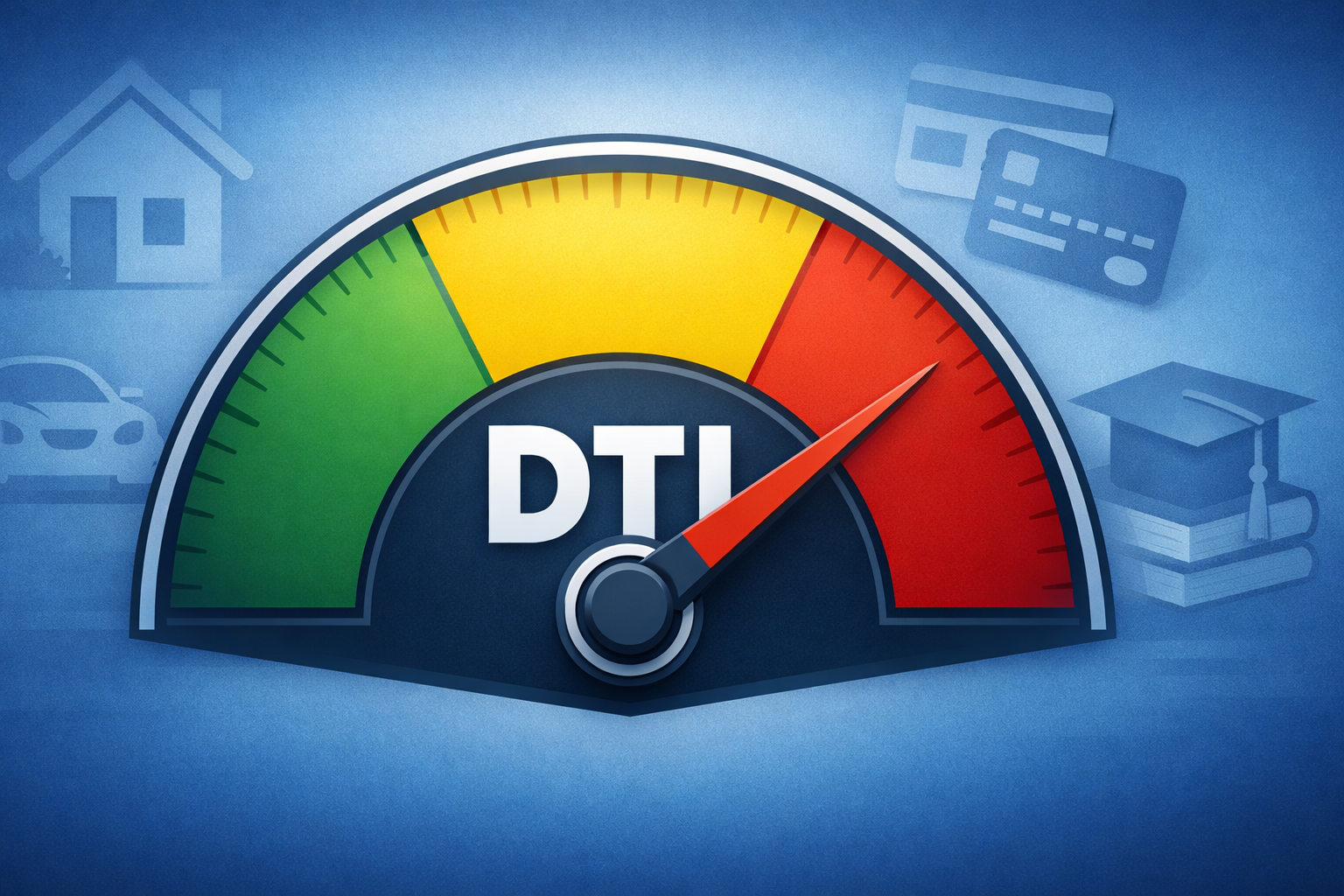

Who qualifies for debt consolidation?

Individuals with stable income, a reasonable debt-to-income ratio, and a fair or better credit score are more likely to qualify for a consolidation loan.

-

What types of debt can be consolidated?

Debt consolidation typically covers unsecured debts such as credit cards, personal loans, and medical bills. Secured debts like mortgages and auto loans are usually not eligible.

-

Does debt consolidation require collateral?

Some consolidation loans may require collateral (such as a home or car), but many options are unsecured and based on creditworthiness.

-

Can I consolidate my debt if I have bad credit?

Approval depends on your financial situation, but lenders may still offer options based on income, employment, or using a co-signer.

Impact on Credit & Results

-

Will debt consolidation affect my credit score?

Applying for a consolidation loan may cause a small, temporary dip in your credit score due to a hard inquiry, but consistent on-time payments can help improve it over time.

-

Can debt consolidation help improve my credit?

Yes, by reducing credit utilization and ensuring consistent on-time payments, consolidation can have a positive impact on your credit over time.

-

Can I still use my credit cards after consolidating debt?

In most cases, no. Many debt consolidation lenders require you to close the accounts included in the consolidation to ensure you don’t accumulate more debt. However, if you're consolidating with a personal loan rather than a structured debt management plan, you may be able to keep your credit cards open—but doing so responsibly is key to avoiding future financial strain.

-

Will I save money by consolidating my debt?

Debt consolidation can save money if it results in a lower interest rate and reduced fees, but total savings depend on loan terms and repayment discipline.

Process & Timeframe

-

How long does it take to consolidate debt?

The application and approval process can take a few days to a few weeks. Once approved, loan funds are typically disbursed within 1–5 business days.

-

How long does it take to pay off a consolidation loan?

Repayment terms vary but typically range from 2 to 7 years, depending on the loan agreement and lender.

-

What happens if my application is denied?

If denied, you may need to explore other debt relief options such as credit counseling, debt settlement, or improving your credit score before reapplying.

Proven Results from People Like You

Real Success Stories

Izzy helped me and after discussing how to get me get out of debt, I felt so much better! Thanks for the service!

Jennifer B

I can’t believe just how much this one phone call has taken off my shoulders. I dug myself into a hole with the payday loan that was going to cost me thousands and thousands of dollars for just a $4000 loan. Izzy has been a lifesaver trying to show me a better way. And I am so grateful and thankful that she was there to help me today She was knowledgeable and friendly and patient with my computer skills and I really appreciate it

Kimberly G

Izzy was very kind and patient. She explained the process in a manner that I was able to understand. Even after the entire process, I am still able to get in contact with Izzy and she will respond in a timely manner. I definitely recommend her to others. 🙂

Rosita C

My representative was Frank G. Amazing experience! I had talked to other agencies that deal with my debt challenge, never felt comfortable until I contacted Relief Strategies. I was extremely lucky to find Frank on the phone. He was understanding, considerate and compassionate. Once we talked and he gave me the facts and opinions i immediately signed for their services! He is great to work with. Give him a call

Frank B

Izzy, you are AMAZING! Your ability to help me see the BIG picture was eye opening and alarming. I was trapped, a POW to debt and I didn't even know. I praise God for you and your team of soldiers, fighting for me. Thank you 😊

Gloria G

Izzy was very personable and knowledgeable about the program and all that it offers. She made it a less stressful experience.

Sonja W

See If You Qualify for Debt Consolidation

Take the first step toward financial relief by checking your eligibility today. It only takes a few minutes.

Learn & Explore

Dive into our curated content for a deeper understanding of debt relief solutions.