By James Farias

Founder & CEO, Relief Strategies, LLC

Quick Summary

“Debt settlement is a scam” is one of the most common statements we hear from people drowning in debt, and it’s understandable why. A troubled history of bad actors, combined with widespread misunderstanding about credit impact, has left many consumers either avoiding help they desperately need or falling prey to the few remaining predatory companies. Here’s the truth: debt settlement is a legitimate, federally-regulated debt relief option that has helped millions of Americans resolve overwhelming debt. But not all providers are created equal. In this article, you’ll learn how to identify legitimate companies, understand what really happens to your credit (and how long it actually takes to recover), and discover how to evaluate.

Introduction

Search “debt settlement” online and you’ll find two extremes: glowing testimonials from companies wanting your business, and horror stories from people who got burned.

The horror stories are real. Before federal regulations caught up with the industry, some companies collected thousands in upfront fees, delivered little to no results, and left consumers worse off than when they started. The Federal Trade Commission and state attorneys general spent years shutting down bad actors, bringing over 250 enforcement actions in the decade leading up to major regulatory reform.

But here’s what those Google searches won’t tell you: the industry has fundamentally changed. Federal law now prohibits the practices that earned debt settlement its bad reputation. Legitimate companies operate under strict regulations, with consumer protections that simply didn’t exist 15 years ago.

The problem? Most people don’t know the difference between a regulated provider and a predatory one. And misinformation about credit impact keeps many people trapped in minimum payment cycles, paying two or three times what they originally borrowed, when better options exist.

This article is an honest look at what debt settlement actually is, how to protect yourself from the remaining bad actors, and how to make an informed decision about whether it’s right for your situation.

Why Debt Settlement Has a “Scam” Reputation (And What Changed)

The debt settlement industry’s reputation problem is earned, but it’s also outdated.

The Bad Old Days

Before 2010, the debt settlement industry operated in a regulatory gray zone. According to the Federal Trade Commission, the pre-regulation landscape was rife with problems:

- Upfront fees: Companies collected thousands of dollars before performing any services, sometimes before even contacting creditors

- False promises: Providers advertised unrealistic results, claiming they could settle all debts for “pennies on the dollar” regardless of individual circumstances

- Hidden consequences: Consumers weren’t told about credit impact, tax implications, or the risk of lawsuits

- Missing money: Some companies collected consumer payments but never forwarded them to creditors, resulting in lawsuits and deeper debt

The Consumer Financial Protection Bureau (CFPB) documented numerous complaints about debt settlement providers during this era, with consumers reporting payments made to companies that were never forwarded to creditors.

The 2010 Regulatory Overhaul

Everything changed on October 27, 2010, when amendments to the FTC’s Telemarketing Sales Rule took effect. As the FTC stated at the time: “Starting on October 27, debt relief telemarketers are on notice, if you charge consumers before actually helping them, you will find the FTC and state enforcers knocking at your door.”

The new rules established clear protections:

- No upfront fees, period. Companies cannot collect any fees until they have successfully settled or otherwise resolved at least one of your debts

- Mandatory disclosures. Providers must tell you how long the process takes, the potential negative consequences of stopping payments, and how much you’ll need to save before they can make settlement offers

- Protected savings accounts. Your deposits must be held in an FDIC-insured account at an institution not affiliated with the debt settlement company, and you must be able to withdraw your money at any time without penalty

- No deceptive claims. Companies cannot misrepresent their services, success rates, or your likely outcomes

These aren’t suggestions, they’re federal law. Companies that violate them face enforcement action from the FTC, CFPB, and state attorneys general. The CFPB continues to take action against debt settlement companies that charge unlawful fees, as recently as 2021 when they pursued a $7.7 million judgment against a company for TSR violations.

How to Identify a Legitimate Debt Settlement Company

Despite federal regulations, some bad actors still exist. Here’s how to protect yourself:

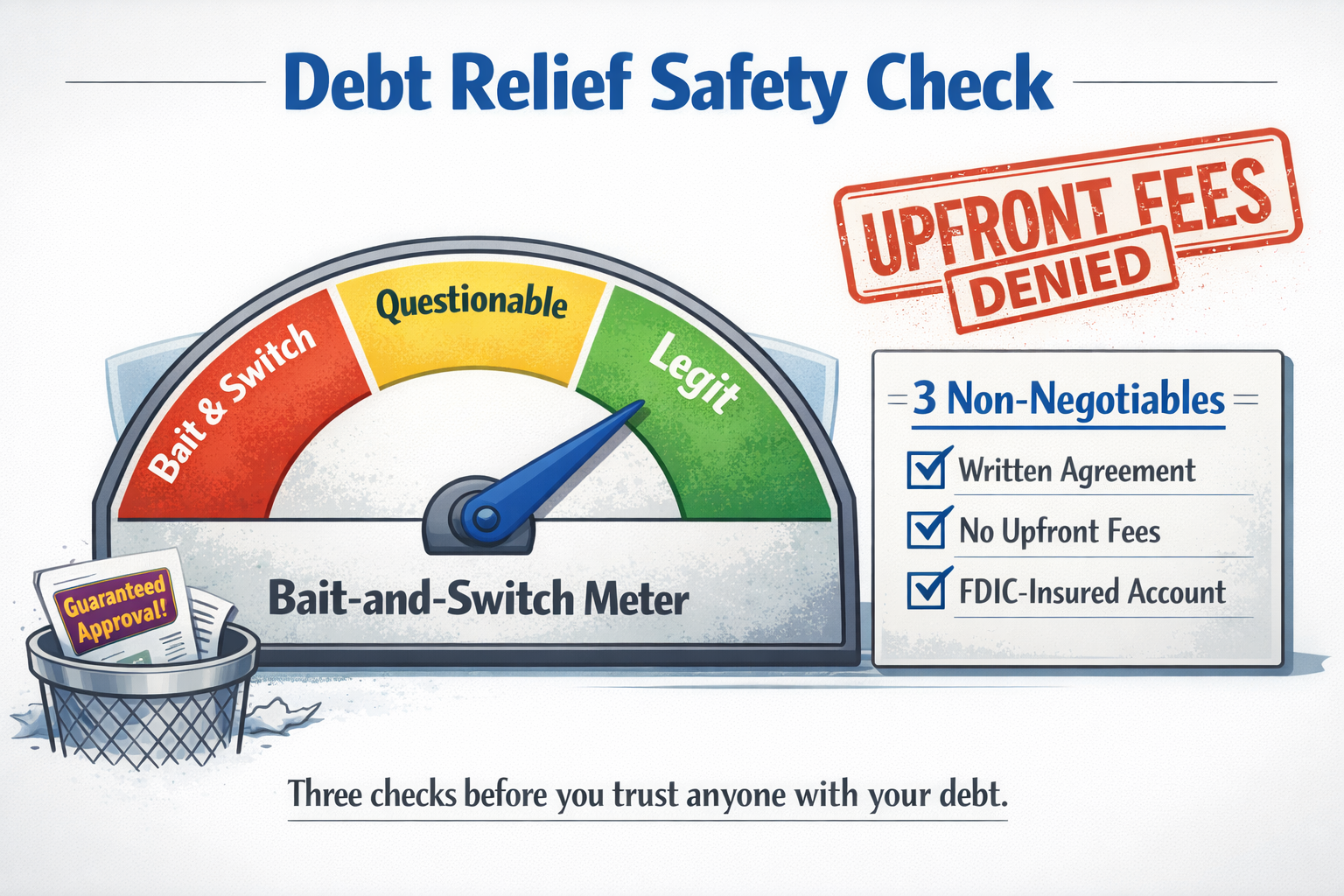

The Three Non-Negotiables

Any legitimate debt settlement company will meet all three of these criteria. If a company fails even one, walk away.

1. Written Agreement Before You Commit

A reputable company will provide a detailed written agreement that explains exactly how the program works, what fees you’ll pay, and what you can expect, before asking you to sign anything. They’ll encourage you to take time to review it, ask questions, and even consult with others.

Red flag: Any company that pressures you to commit immediately, won’t put terms in writing, or seems reluctant to answer questions about their process.

2. No Upfront Fees

This is federal law, not just a best practice. Under the FTC’s Telemarketing Sales Rule, debt relief companies cannot charge fees until after they have settled at least one of your debts and you have made at least one payment toward that settlement.

Red flag: Any request for payment before services are performed. This includes “enrollment fees,” “administrative fees,” or any other creative name for upfront charges.

3. FDIC-Insured Escrow Account You Control

Your deposits should go into a dedicated account at an FDIC-insured financial institution. According to the FTC rule, this account must meet specific requirements: the debt settlement company cannot own or control the account administrator; you must own the funds and any interest earned; and you must be able to withdraw at any time without penalty.

Settlement funds can only be disbursed after you accept a proposed settlement, not before, and not without your explicit approval.

Red flag: Any arrangement where the company directly controls your money, where you can’t access your funds freely, or where settlements are accepted without your approval.

Additional Signs of a Trustworthy Provider

Beyond the three non-negotiables, look for these indicators of legitimacy:

- Industry certification: The International Association of Professional Debt Arbitrators (IAPDA) provides training and certification for debt settlement professionals. IAPDA-certified agents receive training in federal and state regulations, ethical standards, and clear communication. Nine states (Delaware, Kentucky, Minnesota, Nevada, Rhode Island, Tennessee, Texas, Utah, and Virginia) now require debt settlement agents to be IAPDA-certified to operate legally.

- Realistic expectations: Legitimate providers tell you what settlement typically looks like (often 40-60% of the original debt), explain that not all creditors may settle, and are upfront about risks including credit impact and potential lawsuits.

- Lawsuit support: Reputable companies acknowledge that creditors may sue during the settlement process and have support systems in place, whether through legal insurance or affiliated law firms.

- Clean regulatory history: Check with your state attorney general and the Better Business Bureau. Search the company name plus “complaint” or “enforcement action” online.

Warning Signs of a Scam

According to the FTC’s consumer guidance, only scammers will:

- Guarantee to settle all your debts or promise specific results

- Try to enroll you without reviewing your financial situation

- Claim to be part of a “government” debt relief program

- Tell you to stop communicating with creditors without explaining the consequences

- Claim they can stop all debt collection lawsuits

The Credit Impact Reality: What Actually Happens (And How Long It Lasts)

Let’s address the elephant in the room: yes, debt settlement affects your credit. But the reality is far more nuanced than most people understand, and far less permanent than they fear.

What Actually Happens to Your Credit

According to Experian, when you settle a debt for less than the full amount owed, it’s reported to credit bureaus as “settled” or “settled for less than the full amount.” This indicates you didn’t pay the original terms, which creditors view as higher risk.

The impact varies based on your starting point:

- If you start with a credit score of 700+, you may see a drop of 100-160 points

- If your score is already below 700 (likely if you’re struggling with debt), the drop is typically smaller, often 45-65 points

Here’s what many people miss: if you’re already behind on payments, considering debt settlement, or struggling to keep up with minimums, your credit is likely already taking hits. Late payments, high utilization, and collection accounts all damage your score. Settlement often isn’t starting the damage, it’s part of resolving a situation that’s already causing harm.

The Recovery Timeline

A settled account stays on your credit report for seven years from the date of the first missed payment that led to the settlement, not seven years from when you settled. This is an important distinction.

But here’s what the headlines don’t tell you: the impact diminishes significantly over time. According to credit experts:

- 6-24 months: With responsible credit behavior, many people see meaningful score improvement within the first two years after settlement

- 2+ years: Lenders looking at mortgage applications focus most heavily on the last two years of credit history

- Ongoing: As the settlement ages, its impact on your score decreases, especially if you’re building positive payment history on other accounts

As McCarthy Law notes, “You don’t have to wait seven years to start rebuilding your credit. You can take action right away to improve your score.”

The Comparison That Matters

When evaluating credit impact, the question isn’t “Will settlement hurt my credit?” It’s “Compared to what?”

- Compared to paying minimums indefinitely: You’ll likely have years of high utilization (damaging your score) and pay 2-3x what you borrowed in interest

- Compared to defaulting without settlement: Collection accounts, charge-offs, and potential judgments all stay on your report for seven years AND leave you still owing the full debt

- Compared to bankruptcy: Chapter 7 bankruptcy stays on your credit report for 10 years; Chapter 13 for 7 years, and both have more severe immediate impact

💡 Want to see how different options would affect your specific situation? Our free Credit Score Impact Simulator shows you projected credit score recovery timelines for debt settlement vs. bankruptcy vs. continuing with minimum payments, with no personal information required.

The Problem With Uneducated “Debt Specialists”

Here’s an uncomfortable truth about the debt relief industry: not everyone calling themselves a “debt specialist” or “debt consultant” actually knows what they’re talking about.

Some representatives at debt settlement companies receive minimal training. They may understand enough to get you enrolled, but not enough to properly explain:

- Exactly how and when your credit will be affected

- The realistic timeline for credit recovery

- How debt settlement compares to other options for your specific situation

- Tax implications of forgiven debt

- What happens if a creditor sues during the program

The result? Some consultants “tap dance” around credit impact, saying things like “your accounts will need to become delinquent” without actually discussing what that means for your credit score or how long recovery takes. They’re not necessarily being deceptive, they may simply not have the training to explain it properly.

This is why industry certification matters. As IAPDA notes, “Debt settlement agents often work with consumers during one of the most stressful periods of their lives. Certification ensures agents are properly trained to provide accurate information, follow regulatory requirements, and guide consumers responsibly through the process.”

Questions to ask any debt consultant:

- “What certifications do you hold?” (Look for IAPDA certification)

- “Exactly how will this affect my credit, and for how long?”

- “What happens if a creditor sues me during the program?”

- “Are there any tax implications I should know about?”

- “What are my alternatives, and why is settlement better for my situation?”

If they can’t answer these questions clearly and completely, that’s a red flag, not necessarily about the company, but about whether you’re getting the guidance you need.

Making an Informed Decision Without the Pressure

Here’s what frustrates us about this industry: most people can’t get straight answers about their financial situation without immediately being pushed into a sales conversation.

You want to understand your debt-to-income ratio? Here’s a form, and your phone number so a salesperson can call. Curious about how settlement might affect your credit? Schedule a “free consultation” that’s really a sales pitch. Want to see what you might save? We’ll tell you after you provide your Social Security number.

We built something different.

At Relief Strategies, we created a suite of free financial assessment tools designed to give you a complete picture of your situation, with no personal information required, no sales calls unless you want them, and no obligation whatsoever.

Our tools include:

- DTI Calculator: See where you stand financially and whether your debt is manageable or approaching crisis level

- Minimum Payment Trap Calculator: Discover how much you’ll actually pay over time if you continue with minimum payments (spoiler: it’s often 2-3x what you borrowed)

- Credit Score Impact Simulator: See realistic projections for how different options, settlement, bankruptcy, or continuing as-is, would affect your credit over time

- Financial Stress Assessment: Evaluate how debt is affecting your life beyond just the numbers

- Debt Settlement Calculator: Calculate potential savings with transparent fee disclosure, including our fees, not hidden until a sales call

Why do we give this away? Because we believe everyone deserves to understand their financial situation clearly before making any decisions. And honestly, informed consumers make better clients. When someone chooses to work with us, they do so because they understand exactly what they’re getting into, not because they were pressured into a decision they don’t fully understand.

💡 Ready to get the complete picture? Start with our DTI Calculator, then explore our other free tools, all without providing any personal information or committing to anything.

Is Debt Settlement Right for You?

Debt settlement isn’t for everyone. It’s one tool in a larger toolkit of debt relief options, and it’s important to understand when it makes sense and when other solutions might be better.

Debt settlement may be appropriate if:

- You have significant unsecured debt (credit cards, medical bills, personal loans)

- You’re unable to pay the full amount but could afford reduced payments

- Traditional solutions like consolidation loans won’t work due to your debt-to-income ratio

- You want to avoid bankruptcy

- You’re already behind on payments or expect to fall behind

Debt settlement may NOT be the best option if:

- You’re current on all payments and can realistically pay off debt within 3-5 years

- You qualify for a lower-interest consolidation loan

- Your situation is so severe that bankruptcy would be more appropriate

- You have primarily secured debts (mortgages, auto loans) or federal student loans

The key is making an informed decision based on your specific circumstances, not being talked into something by a salesperson or scared away by outdated horror stories.

Conclusion

“Debt settlement is a scam” made sense as a warning 15+ years ago. Today, it’s an oversimplification that keeps people trapped in debt when legitimate help exists.

The reality: debt settlement is a federally-regulated debt relief option that has helped millions of Americans resolve overwhelming debt. But like any industry, it has good actors and bad actors. Your job is knowing the difference.

Remember the three non-negotiables:

- Written agreement before you commit

- No upfront fees (it’s federal law)

- FDIC-insured escrow account that only you control

Understand the credit impact, it’s real but temporary, and for many people it’s better than the alternative paths they’re on.

Work with certified professionals who can clearly explain your options, the risks, and the realistic outcomes.

And most importantly: get informed before you make any decisions. Use tools that give you straight answers without requiring personal information or subjecting you to sales pressure.

The difference between people who break free from debt and people who stay trapped isn’t intelligence or willpower. It’s having accurate information and the right guidance. Now you have the information. The next step is yours.

Need Help?

If you’re ready to explore your options with a company that puts transparency first, Relief Strategies can help. We’re IAPDA-certified, never charge upfront fees, and believe you should understand exactly what you’re getting into before you commit to anything.

Start by using our free calculator suite to understand your situation. No personal information required. No sales calls unless you want them. Just the numbers you need to make an informed decision.

Visit ReliefStrategies.com or call us at (888) 870-7922 for a free, no-obligation consultation.

About the Author

James Farias is the CEO of Relief Strategies, LLC, a firm dedicated to helping individuals achieve financial freedom through effective debt relief solutions. With over 30 years of business leadership experience and a deep passion for empowering others, James has guided many clients through the process of reducing debt and regaining control of their finances. He understands how quickly debt can overwhelm even disciplined individuals and focuses on strategies that lower monthly payments, relieve financial stress, and create opportunities for a more secure future. Connect with James on LinkedIn or visit Relief Strategies to learn more about how he and his team can help you build financial confidence.

References

- CBS News. (2025, January 7). How long do settled accounts stay on your credit report? Retrieved from https://www.cbsnews.com/news/how-long-do-settled-accounts-stay-on-your-credit-report/

- Consumer Financial Protection Bureau. (n.d.). What is a debt relief program and how do I know if I should use one? Retrieved January 26, 2026, from https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-relief-program-and-how-do-i-know-if-i-should-use-one-en-1457/

- Consumer Financial Protection Bureau. (2021). CFPB takes action against debt-settlement company for charging consumers unlawful fees. Retrieved from https://www.consumerfinance.gov/about-us/newsroom/cfpb-takes-action-against-debt-settlement-company-for-charging-consumers-unlawful-fees/

- Credit Strong. (2024, October 30). How long does it take to rebuild credit after debt settlement? Retrieved from https://www.creditstrong.com/how-long-does-it-take-to-rebuild-credit-after-debt-settlement/

- Experian. (2025, May 2). How long do settled accounts remain on a credit report? Retrieved from https://www.experian.com/blogs/ask-experian/how-long-do-settled-accounts-remain-on-a-credit-report/

- Federal Trade Commission. (2010, July). FTC issues final rule to protect consumers in credit card debt. Retrieved from https://www.ftc.gov/news-events/news/press-releases/2010/07/ftc-issues-final-rule-protect-consumers-credit-card-debt

- Federal Trade Commission. (2010, October). Debt relief companies prohibited from collecting advance fees under FTC rule that takes effect October 27, 2010. Retrieved from https://www.ftc.gov/news-events/news/press-releases/2010/10/debt-relief-companies-prohibited-collecting-advance-fees-under-ftc-rule-takes-effect-october-27-2010

- Federal Trade Commission. (2025, May 29). Debt relief services & the Telemarketing Sales Rule: A guide for business. Retrieved from https://www.ftc.gov/business-guidance/resources/debt-relief-services-telemarketing-sales-rule-guide-business

- Federal Trade Commission. (n.d.). How to get out of debt. Consumer Advice. Retrieved January 26, 2026, from https://consumer.ftc.gov/articles/how-get-out-debt

- InCharge Debt Solutions. (2025, April 24). Does debt settlement hurt your credit? Retrieved from https://www.incharge.org/debt-relief/debt-settlement/effect-on-credit-report/

- International Association of Professional Debt Arbitrators. (n.d.). IAPDA certification. Retrieved January 26, 2026, from https://iapda.org/

- International Association of Professional Debt Arbitrators. (2026, January 23). IAPDA certification emerges as a critical standard in the debt settlement industry [Press release]. PR Newswire. Retrieved from https://www.prnewswire.com/news-releases/iapda-certification-emerges-as-a-critical-standard-in-the-debt-settlement-industry-302669079.html

- McCarthy Law PLC. (2025, May 6). How long does debt settlement stay on your credit report? Retrieved from https://mccarthylawyer.com/2025/05/06/how-long-does-debt-settlement-stay-on-your-credit-report/

- 16 C.F.R. Part 310 – Telemarketing Sales Rule. (2024). Retrieved from https://www.ecfr.gov/current/title-16/chapter-I/subchapter-C/part-310