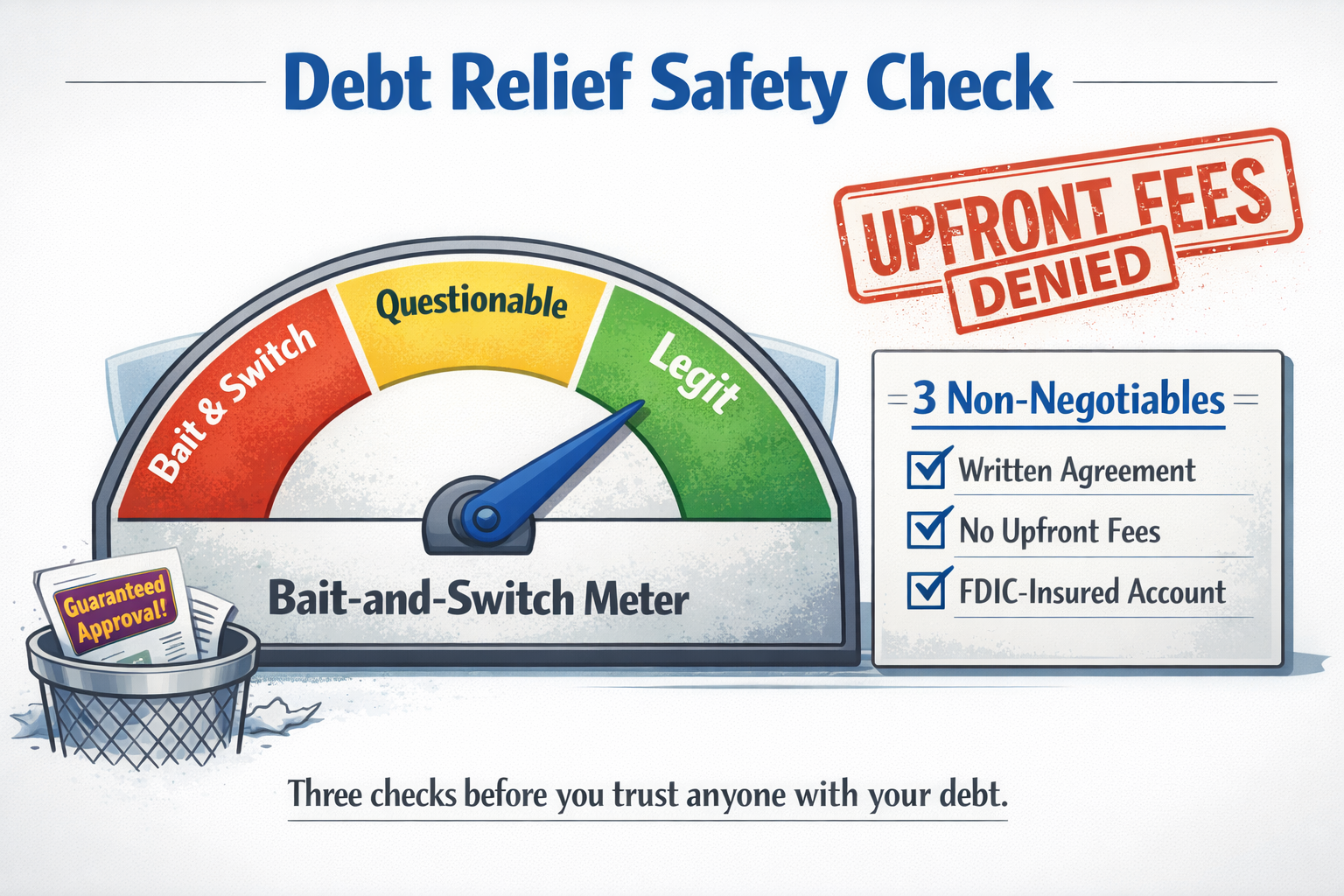

“Debt settlement is a scam” made sense 15 years ago. Today, it’s an oversimplification. Learn how the 2010 FTC rules changed the industry, three non-negotiables for identifying legitimate companies, and what really happens to your credit.

Tag: Debt Relief

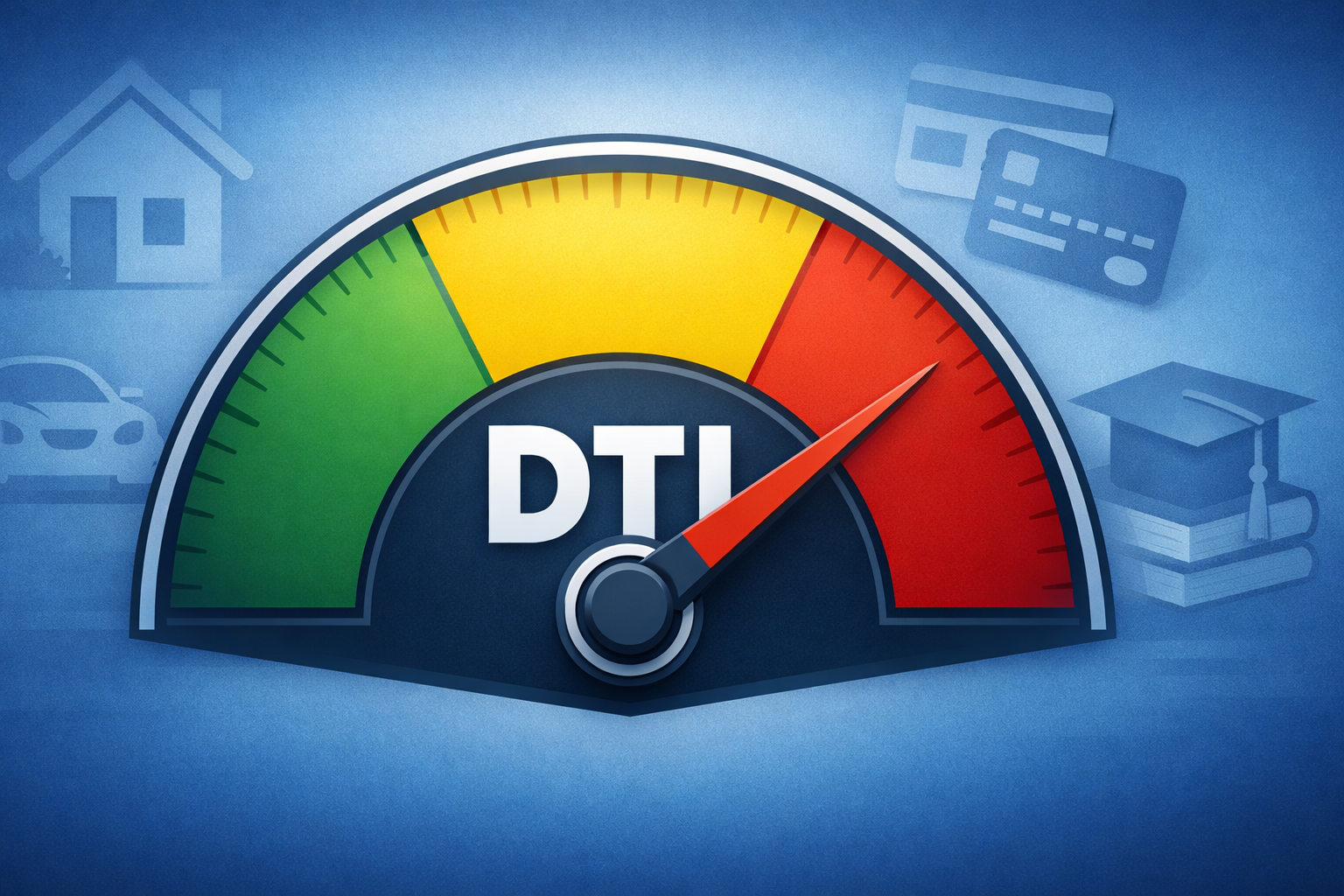

DTI is a financial vital sign. If too much of your income is already spoken for, no budget trick will fix it. Here’s how to calculate your DTI, what it means, and when it’s time to get real help.

With credit card APRs nearing 25% and relief from the Fed nowhere in sight, families are facing painful choices. This article breaks down what today’s interest rates mean for your wallet, and the debt settlement strategies that might actually help.

The Senate’s “Big Beautiful Bill” is here, and it could either boost your budget or tighten the squeeze. This article breaks down the winners, losers, and what to watch as taxes, benefits, and household costs shift.

The Senate just passed the most sweeping student loan overhaul in decades. From new limits to longer forgiveness timelines, this article breaks down what it means for borrowers today and tomorrow.

Why Credit Card Debt Is Rising in Some States and Falling in Others: What Every Consumer Should Know

Some states are digging deeper into debt while others are starting to climb out. This article breaks down the newest credit card data, explains the “why” behind the trends, and shows you what it means for your wallet.

Credit card delinquencies are rising fast—even as overall debt shrinks. This guide explores what’s causing the spike, who’s affected, and how consumers can regain control before it’s too late.

APR averages have surged to 24%…the highest in history. This article explains how we got here, what it costs the average household, and what you can do about it.

Major changes to federal student loan programs are on the horizon. This breakdown explains what the One Big Beautiful Bill Act (OBBBA) means for current borrowers, future students, and schools.

Debt settlement can impact your credit, but that doesn’t mean recovery is out of reach. Learn how to protect your score during the process, and rebuild it stronger after, with real steps that work in the real world.

Recent Posts

Tags

All Services

- Awards & Recognition

- Client Success & Debt Relief Outcomes

- Company Updates

- Consumer Alerts

- Consumer Protection & Debt Relief

- Consumer RIghts & Protections

- Credit & Debt Management

- Credit Impact

- Debt Management Strategies

- Debt Relief & Economic Policy

- Debt Relief Insights

- Debt Settlement Insights

- Economic Policy & Personal Finance

- Events

- Financial Education & Awareness

- Student Loan News

- Student Loans & Financial Aid