A Free Live Webinar: Understand the trap. Escape the cycle. Empower others. Every Tuesday at 4 PM PST

Debt & Credit Uncovered: What They Don’t Want You to Know

- Live Weekly Webinar

- Expert Insights

- Real-World Solutions

Why This Webinar Matters

- $1.2 trillion in outstanding balances

- 45% of households carry credit card debt

- 47% say money stress affects mental health

- Most wait 18–24 months before seeking help

You’re Not Alone — But You Don’t Have to Stay Stuck

Debt isn’t just about money — it impacts your health, relationships, and future. This free webinar uncovers how the credit system works against you, how to break free, and how you can help others do the same.

What You’ll Learn

The Debt Trap

Why minimum payments are designed to keep you stuck.

Emotional Cost

How debt impacts your health and confidence.

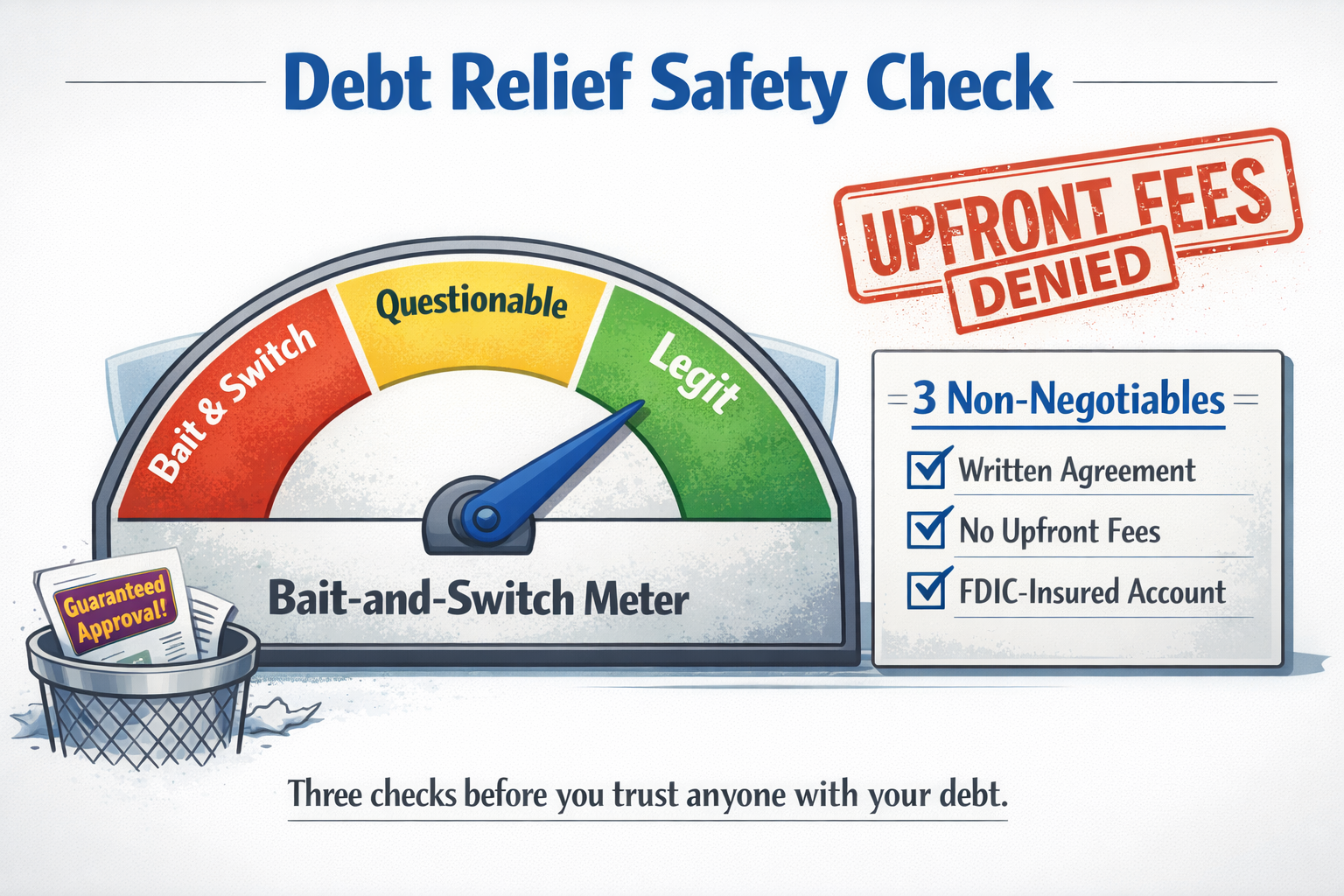

Your Real Options

From consolidation to settlement — what works and when.

Helping Others

How to turn your story into purpose and opportunity.

Free Live Webinar: Tuesday's @ 4 PM PT

Hosted by James Farias, CEO of Relief Strategies

Two Paths

I Need Help With My Debt

Talk to a certified debt relief expert who understands what you’re going through — no pressure, no judgment. We’ll walk you through your options, answer your questions honestly, and help you take the next step toward lasting relief with clarity, confidence, and a custom plan that truly fits your life.

I Want to Help Others

If you’ve overcome your own debt or simply care about helping others, becoming a debt relief agent could be your next step. Our agents make a real impact in their communities while earning meaningful income — all with flexible, remote-friendly opportunities. Purpose and profit can go hand in hand.

About the Host

James Farias is the founder and CEO of Relief Strategies, a mission-driven company dedicated to helping individuals escape the burden of debt with clarity and confidence. With years of leadership in financial services and a passion for simplifying complex systems, James created this webinar to expose the traps built into the credit system — and offer real, workable paths forward. His goal is simple: to replace confusion and shame with knowledge, strategy, and support that actually makes a difference.

Real Stories. Real Change.

I was meeting with a client to provide retirement planning and found out she was not sleeping, or even eating well due to the stress of losing both parents within a month and then having unmanaged debt to deal with. She was at a breaking point until I connected her to Relief Solutions. The client is so grateful that she was taken care of in such a timely manner.

Sylvia S

Izzy is our angel!! She is helping folks left and right save thousands of dollars on their debt! When you can take someone's debt that was paying $300 on just one loan a month and incorporate all of their debt and now it's only $375/mo for everything it's an answer straight from heaven! Thank you, Izzy and Relief Strategies!!

Lauri K

Another Relief Strategies WIN for one of our clients. We just helped Sydney H's client. She had $118,420 in federal student loan debt before interest. Her payments are about to be $758/mo. WIth the PSLF program she will now only be paying $79.97/mo. with a total payback of $11,640. We are no also enrolling her husband's debt!

Susan H

Izzy helped me and after discussing how to get me get out of debt, I felt so much better! Thanks for the service!

Jennifer B

Let’s Break the Cycle — Together

Whether you need relief or want to create it for others, this webinar is your first step.