Your path to financial freedom, simplified. Explore the step-by-step journey to resolving your debt with confidence and support.

How It Works

- Flexible Enrollment Options

- Proven Debt Solutions

- Fast Financial Relief

Start Your Journey to Financial Freedom with Relief Strategies

Our Committment to You

What You Can Expect

At Relief Strategies, we are committed to guiding you through challenging financial circumstances with understanding and expertise. Our process is designed to be transparent and straightforward, offering practical solutions to help you regain control and confidence in your financial future. Let us partner with you on a journey to stability and peace of mind.

Your Step-by-Step Journey

Step 1: Initial Consultation

Begin with a free, no-obligation consultation to discuss your financial situation, goals, and challenges.

Step 2: Personalized Assessment & Service Selection

Our team conducts a thorough assessment of your financial needs to recommend tailored solutions.

Step 3: Enrollment & Onboarding

We guide you through a simple onboarding process, including account setup and document submission.

Step 4: Ongoing Support & Progress Updates

We provide periodic progress reports and are always available to answer questions or make adjustments as needed.

Step 5: Completion & Next Steps

Successfully settle your debts and receive guidance on maintaining financial stability.

Real Journeys, Real Results

Transformative Success Stories

Izzy helped me and after discussing how to get me get out of debt, I felt so much better! Thanks for the service!

Jennifer B

I can’t believe just how much this one phone call has taken off my shoulders. I dug myself into a hole with the payday loan that was going to cost me thousands and thousands of dollars for just a $4000 loan. Izzy has been a lifesaver trying to show me a better way. And I am so grateful and thankful that she was there to help me today She was knowledgeable and friendly and patient with my computer skills and I really appreciate it

Kimberly G

Izzy was very kind and patient. She explained the process in a manner that I was able to understand. Even after the entire process, I am still able to get in contact with Izzy and she will respond in a timely manner. I definitely recommend her to others. 🙂

Rosita C

My representative was Frank G. Amazing experience! I had talked to other agencies that deal with my debt challenge, never felt comfortable until I contacted Relief Strategies. I was extremely lucky to find Frank on the phone. He was understanding, considerate and compassionate. Once we talked and he gave me the facts and opinions i immediately signed for their services! He is great to work with. Give him a call

Frank B

Izzy, you are AMAZING! Your ability to help me see the BIG picture was eye opening and alarming. I was trapped, a POW to debt and I didn't even know. I praise God for you and your team of soldiers, fighting for me. Thank you 😊

Gloria G

Izzy was very personable and knowledgeable about the program and all that it offers. She made it a less stressful experience.

Sonja W

Frequently Asked Questions

Get quick answers to common questions about our process and services.

-

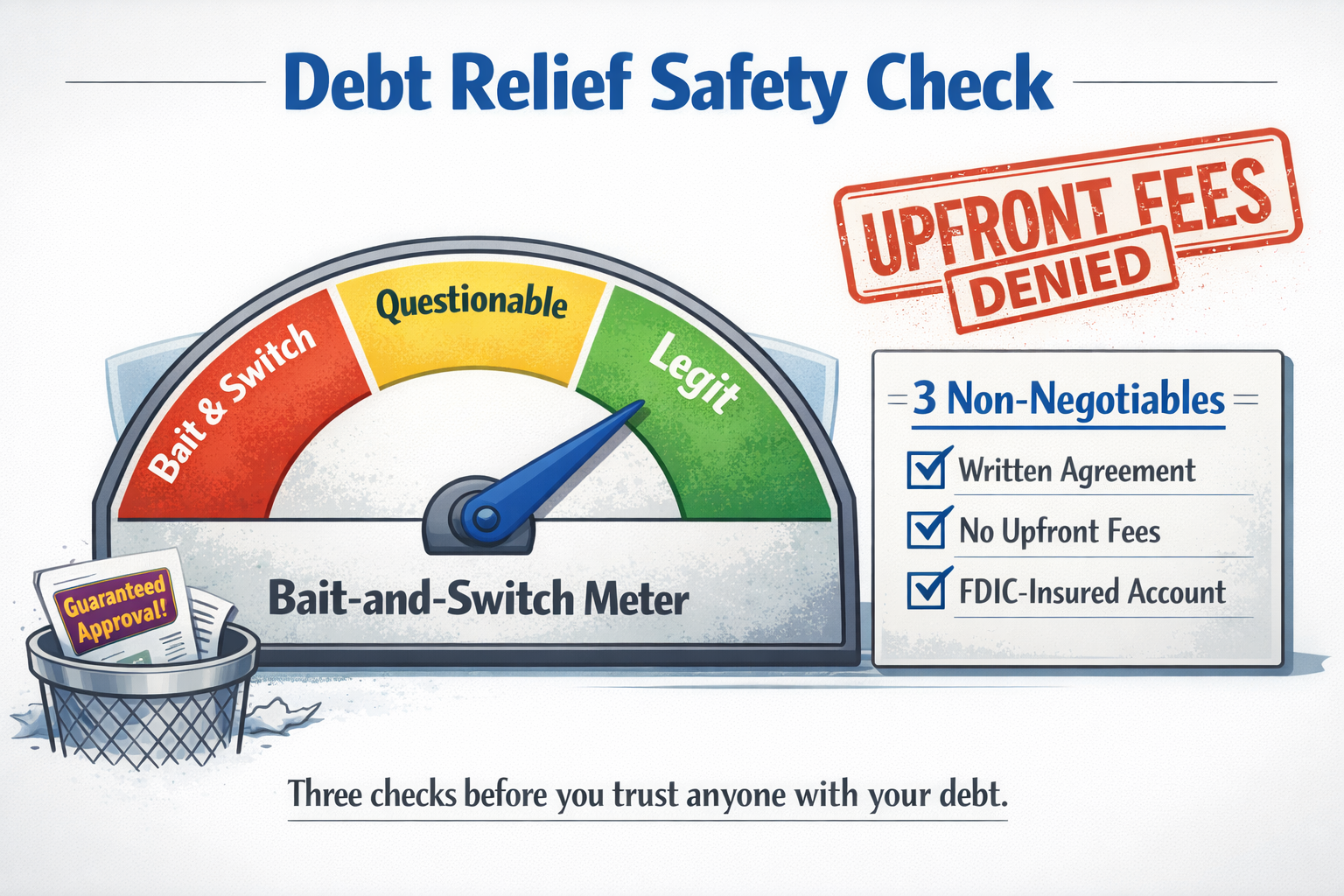

Common Qualifying Factors

Debt settlement can be a lifeline for individuals facing financial hardship, often caused by reduced income, unexpected expenses, or mounting medical bills. This solution is typically available for unsecured debts such as credit card balances, personal loans, and medical debts. While most programs require a minimum of $6,000 in eligible debt to qualify, cases with over $15,000 in debt tend to achieve the most significant results. Understanding these criteria is essential for determining if debt settlement is the right step toward regaining financial stability.

-

Will my information be confidential?

Absolutely. We prioritize your privacy and ensure all your information is kept secure and confidential.

-

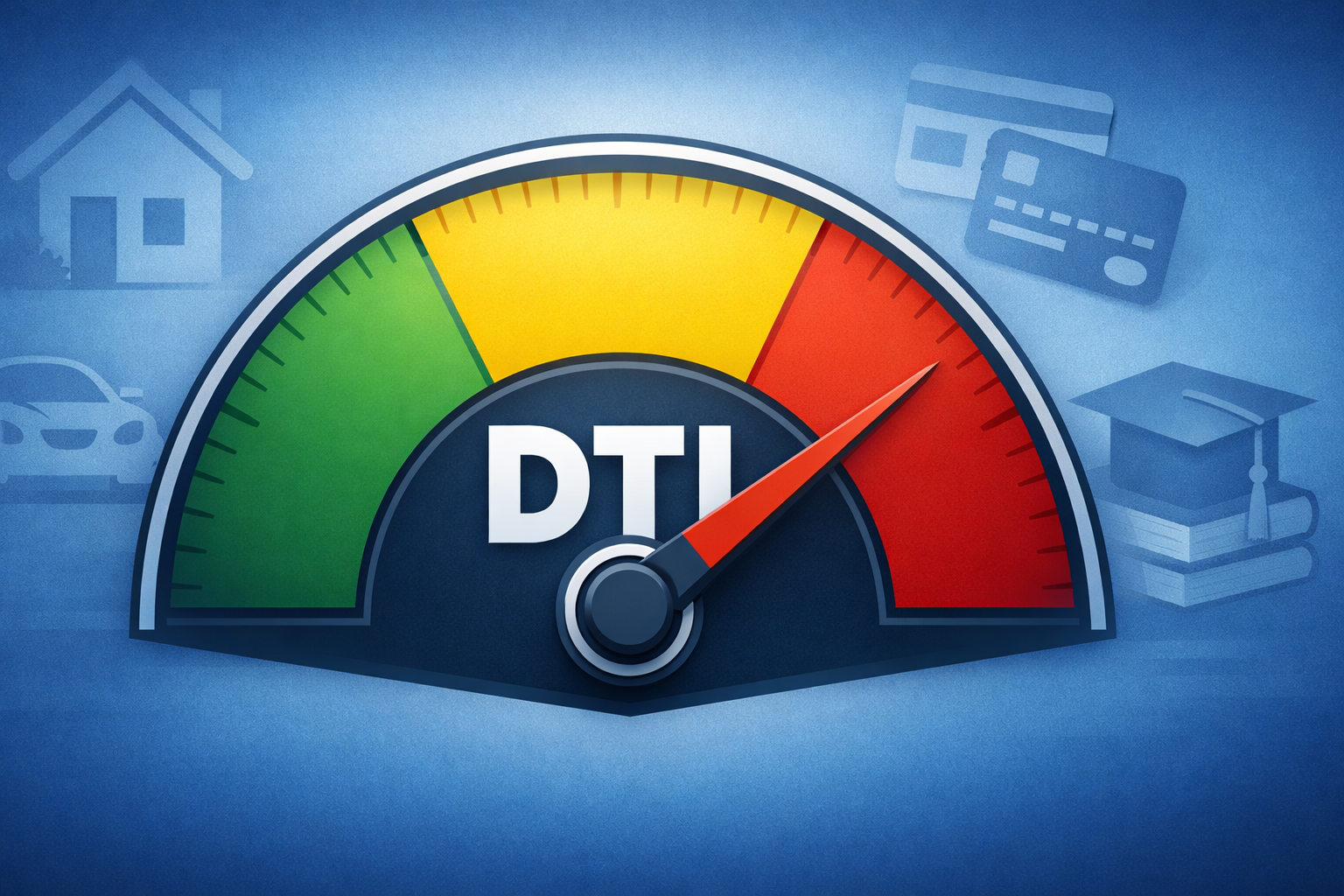

What types of debts can you help with?

We assist with various types of debt to help clients regain financial stability. For unsecured debts, such as credit card debt, medical bills, and personal loans, we offer debt settlement services designed to reduce the total amount owed and create manageable repayment solutions. Additionally, we provide specialized assistance for federal student loans, including navigating forgiveness programs, income-driven repayment plans, and deferment or forbearance options. Whether you're facing challenges with private debts or federal student loans, our team is here to guide you through your available options and develop a personalized plan tailored to your needs.

-

Is there a fee for the initial consultation?

We assist with various types of debt to help clients regain financial stability. For unsecured debts, such as credit card debt, medical bills, and personal loans, we offer debt settlement services designed to reduce the total amount owed and create manageable repayment solutions. Additionally, we provide specialized assistance for federal student loans, including navigating forgiveness programs, income-driven repayment plans, and deferment or forbearance options. Whether you're facing challenges with private debts or federal student loans, our team is here to guide you through your available options and develop a personalized plan tailored to your needs.

Ready to Take Control of Your Debt?

Connect with our team for a free consultation and explore if debt settlement is right for you.

Explore Our Insights

Learn More About Debt Settlement Through Our Expert Articles