By James Farias

Founder & CEO, Relief Strategies, LLC

Quick Summary

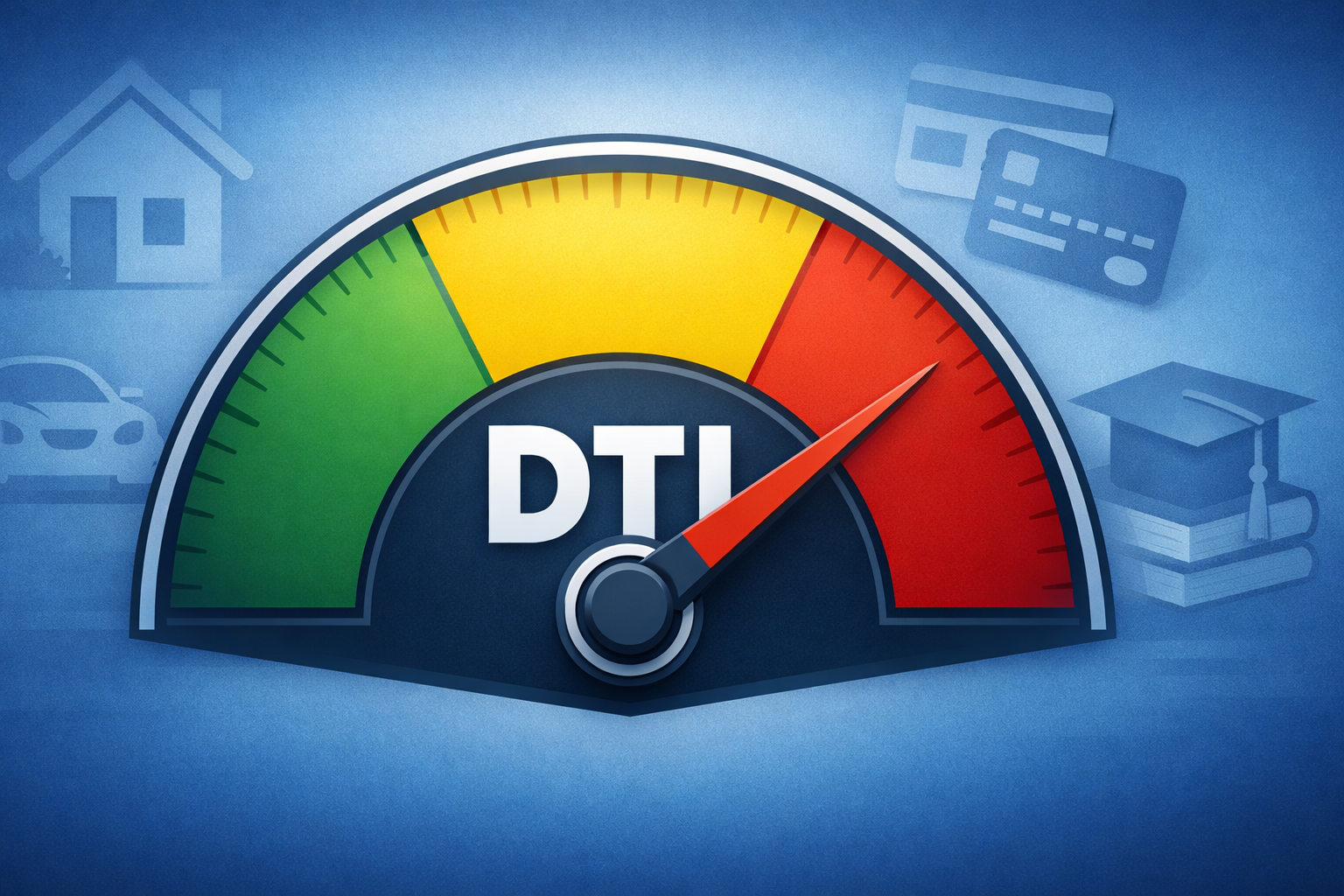

Your debt-to-income ratio is one of the most important numbers in your financial life, yet most people don’t know what theirs is until they’re denied a loan. This simple calculation compares how much debt you’re carrying against how much you earn each month, and it reveals whether your debt is manageable or spiraling toward crisis. Understanding your DTI isn’t just about satisfying lenders; it’s about knowing whether you’re building toward financial security or heading for trouble. In this article, you’ll learn exactly how to calculate your DTI, what your number really means, and most importantly, what to do about it.

Introduction

Most people don’t realize they’re drowning until the water’s over their head.

You’re making your minimum payments. Your credit cards are maxed out, but you’re keeping up. Bills are getting paid, even if it means juggling due dates and occasionally choosing which one to skip. From the outside, everything looks fine. But inside, you know something’s wrong. The stress keeps you up at night. One unexpected expense, one emergency, and the whole house of cards could collapse.

Here’s the problem: most people wait until they’re in crisis mode before they assess whether their debt is actually manageable. By then, options are limited and the damage is done.

There’s a better way. And it starts with a simple calculation that takes less than five minutes but tells you everything you need to know about whether your debt is under control or quietly destroying your financial future.

It’s called your debt-to-income ratio, and by the end of this article, you’ll know yours, what it means, and exactly what to do about it.

What is Debt-to-Income Ratio?

Your debt-to-income ratio, or DTI, is exactly what it sounds like: a comparison of your monthly debt payments to your monthly income. According to the Consumer Financial Protection Bureau, your DTI is calculated by dividing all your monthly debt payments by your gross monthly income and expressing the result as a percentage.

The formula is simple:

DTI = (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100

For example, if you pay $2,000 per month toward debts and earn $6,000 per month before taxes, your DTI is 33%. This means that 33 cents of every dollar you earn goes toward servicing debt.

Lenders care deeply about this number. As Wells Fargo explains, when you apply for credit, lenders evaluate your DTI to assess the risk of extending you additional credit. The higher your DTI, the more of your income is already spoken for, leaving less room to take on new debt or handle unexpected expenses.

There are actually two types of DTI that lenders might calculate:

- Front-end DTI (also called housing ratio): This looks only at housing costs like mortgage, property taxes, insurance, and HOA fees as a percentage of income.

- Back-end DTI (also called total debt ratio): This is the number we’re focused on here. It includes all your monthly debt obligations: housing, credit cards, car loans, student loans, personal loans, and any other recurring debt payments.

When you’re assessing your overall financial health or applying for most types of credit, back-end DTI is what matters. It’s the comprehensive picture of how much of your income is being consumed by debt.

How to Calculate Your DTI

Calculating your DTI is straightforward, but you need to be thorough and honest. Here’s the step-by-step process:

💡 Want to skip the math? Use our free DTI calculator to get your result in under 2 minutes and receive personalized recommendations based on your situation.

Step 1: List All Monthly Debt Payments

Start by adding up everything you’re required to pay each month on debts. According to Bankrate, this includes:

What counts as debt:

- Credit card minimum payments (even if you typically pay more)

- Mortgage or rent payment

- Car loans

- Student loans

- Personal loans

- Home equity loans or lines of credit

- Alimony or child support payments

What doesn’t count:

- Utilities (electric, gas, water)

- Groceries

- Cell phone bills

- Health insurance premiums

- Car insurance

- Subscriptions (Netflix, gym memberships, etc.)

The key distinction, as Wells Fargo notes, is that DTI only includes payments to creditors or lenders for money you’ve borrowed. Regular monthly expenses that aren’t debt don’t count.

Step 2: Calculate Your Gross Monthly Income

Next, you need your gross monthly income. This is your income before taxes and other deductions are taken out. Include:

- Salary or wages

- Bonuses (if regular and predictable)

- Commission income

- Side business income

- Rental income

- Alimony or child support received

- Any other regular income sources

If you’re paid biweekly, multiply one paycheck by 26, then divide by 12 to get your monthly average. If your income varies, average your last 3-6 months.

Step 3: Do the Math

Now divide your total monthly debt payments by your gross monthly income, then multiply by 100.

Real example:

Sarah earns $6,500 per month (gross). Her monthly debt payments are:

- Mortgage: $1,600

- Car loan: $450

- Student loans: $350

- Credit card minimums: $400

- Total: $2,800

Calculation: $2,800 ÷ $6,500 = 0.43 0.43 × 100 = 43% DTI

Common Mistakes to Avoid

According to Experian, people frequently miscalculate their DTI by:

- Using net income (after taxes) instead of gross income

- Forgetting to include all credit card minimum payments

- Leaving out smaller loans like personal loans or Buy Now, Pay Later balances

- Including expenses that aren’t actually debt payments

- Underestimating variable income or overstating irregular income

Be brutally honest in your calculation. The only person you’re fooling by fudging the numbers is yourself.

Ready to calculate yours? Use our DTI calculator to get your exact number and personalized recommendations in less than 2 minutes.

DTI Thresholds: What Your Number Means

Now that you know your DTI, what does it actually mean? According to Bank of America and Wells Fargo, here’s how lenders and financial experts interpret different DTI ranges:

Under 36%: Healthy & Manageable

What it means: You’re in good shape. This is the range that most lenders consider ideal. Wells Fargo notes that at this level, you likely have money left over for saving or spending after you’ve paid your bills.

What you should do:

- Keep doing what you’re doing

- Focus on building emergency savings

- Consider paying down high-interest debt faster

- Take advantage of your strong position to optimize your finances

Lender perspective: Lenders love you at this DTI. You’ll typically qualify for the best interest rates and loan terms.

36-43%: Moderate Risk / Stretched

What it means: You’re in the caution zone. You’re managing, but there’s not much margin for error. Bank of America points out that a DTI above 36% means you may not have much financial cushion.

What you should do:

- Get aggressive about paying down debt

- Build an emergency fund if you don’t have one

- Avoid taking on new debt

- Look for ways to increase income or reduce expenses

- Consider refinancing high-interest debt

Lender perspective: Many lenders will still work with you, though you may not qualify for the best rates. Some mortgage lenders start getting concerned around 43%.

44-49%: High Risk / Stressed

What it means: You’re in the red flag zone. CBS News reports that when monthly debt payments exceed 40% of gross income, it’s a strong indicator that your debt load is becoming unsustainable. At this level, you’re likely struggling to make minimum payments and have little room for savings or unexpected expenses.

Warning signs at this level:

- Using credit cards for necessities

- Juggling which bills to pay each month

- No emergency fund

- One setback away from falling behind

What you should do:

- Take immediate action to reduce debt

- Stop using credit cards entirely

- Consider debt consolidation if you have good credit

- Seek professional help from a credit counselor

- Explore income-driven repayment plans for student loans

Lender perspective: Traditional debt solutions like consolidation loans may still work, but approval becomes harder and rates less favorable.

50%+: Critical / Unsustainable

What it means: You’re in crisis territory. More than half your income is going to debt payments, which is mathematically unsustainable. According to financial experts cited by Credit.org, this level indicates serious financial distress.

Reality check: Wells Fargo notes that with more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may significantly limit your borrowing options.

What you should do:

- Recognize this requires professional intervention

- Stop using credit immediately

- Understand that traditional debt relief options (like consolidation) likely won’t solve the problem

- Consider debt settlement or bankruptcy as viable options

- Seek immediate help from a debt relief professional

Lender perspective: Most traditional lenders won’t approve new credit at this level. You’re viewed as too high-risk.

Beyond DTI: Other Warning Signs Debt is Unmanageable

Your DTI tells part of the story, but it’s not the whole picture. According to experts at InCharge Debt Solutions and Credit.org, these behavioral warning signs often indicate debt has become unmanageable, even if your DTI looks acceptable on paper:

You’re only making minimum payments (or less). When you can only afford minimum payments, you’re barely covering interest. Credit.org points out that even modest balances could take years to pay off this way, and you’ll pay far more than you originally borrowed.

You’re using credit for necessities. If you’re using credit cards to buy groceries or pay utilities because you don’t have cash, that’s a clear signal that your income isn’t covering your needs. CBS News identifies this as one of the strongest indicators of financial distress.

You’re avoiding creditor calls or bills. Ignoring communications from lenders or avoiding opening statements is a psychological red flag that you know the situation is deteriorating.

You have no emergency fund. If an unexpected $500 expense would force you to use credit or miss a payment, you’re living on the edge.

You’re losing sleep over finances. Financial stress that keeps you up at night or causes constant anxiety is a sign that debt has crossed from manageable to overwhelming.

You’re considering payday loans. According to the Consumer Financial Protection Bureau, cash advances and payday loans are extremely expensive forms of borrowing that should only be used in true emergencies. If you’re considering them regularly, your financial situation has become critical.

You’re behind on payments. Late fees, penalty interest rates, and collection calls are obvious signs that debt has become unmanageable. As Credit.org notes, even one missed payment can stay on your credit report for up to seven years.

You’re “robbing Peter to pay Paul.” If you’re strategically choosing which bills to pay based on which creditor is calling the most, you’re in trouble.

These warning signs matter because they indicate that even if your DTI calculation looks manageable, your actual financial behavior tells a different story. Pay attention to both the numbers and your daily reality.

Solutions Based on Your DTI Level

The right solution depends on where you fall on the DTI spectrum. Here’s what makes sense for each range:

If Your DTI is Under 36%: Optimize and Prevent

You’re in a strong position. Your focus should be on maintaining and improving:

Debt payoff strategies:

- Use the debt avalanche method (paying off highest interest rates first) to minimize total interest paid

- Or try the debt snowball method (smallest balances first) for psychological momentum

- Make extra payments toward principal when possible

Consider refinancing: If you have high-interest debt, look into refinancing options like balance transfer credit cards (if you have good credit) or personal loans with lower rates.

Build your financial foundation:

- Establish or grow your emergency fund (aim for 3-6 months of expenses)

- Maximize retirement contributions

- Focus on long-term wealth building

Prevention: Keep your DTI low by being selective about taking on new debt and maintaining your financial discipline.

If Your DTI is 36-43%: Get Aggressive

You’re still in manageable territory, but you need to take action before things get worse.

Budget optimization: According to Bankrate, creating and sticking to a detailed budget is essential. Look for areas to cut expenses and redirect that money to debt payoff.

Debt consolidation loan: If you have decent credit, consolidating multiple high-interest debts into one lower-interest loan can reduce your monthly payment and help you pay off debt faster. Experian notes that this works best when you qualify for an interest rate lower than what you’re currently paying.

Balance transfer options: A 0% APR balance transfer credit card can give you 12-18 months of interest-free debt payoff time, but only if you have a plan to pay it off during the promotional period.

Credit counseling: Consider working with a nonprofit credit counseling agency. They can help you create a debt management plan that may include reduced interest rates negotiated with your creditors.

Increase income: Look for opportunities to earn more through asking for a raise, taking on overtime, or starting a side hustle. Even a few hundred extra dollars per month can make a significant difference.

If Your DTI is 44-49%: Seek Professional Help

At this level, traditional DIY solutions may not be enough.

Everything above, plus:

Professional credit counseling: This should be your first stop. A certified credit counselor can assess your complete financial situation and recommend the best path forward.

Aggressive income increase: At this DTI level, cutting expenses alone probably won’t solve the problem. You need to seriously explore ways to increase your income.

Debt management program (DMP): Through a credit counseling agency, a DMP can reduce your interest rates and create a structured repayment plan, typically lasting 3-5 years.

Debt consolidation (if qualified): You may still qualify for consolidation, though it’s getting harder at this DTI level.

Consider debt settlement: This might be on the table if your situation is deteriorating, though it should be explored carefully with professional guidance.

If Your DTI is 50%+: Consider Debt Settlement or Bankruptcy

At this level, you need immediate intervention. Traditional solutions likely won’t work because the math simply doesn’t add up.

Debt settlement: According to debt relief experts, debt settlement can reduce your total debt burden by negotiating with creditors to accept less than the full amount owed. This is particularly appropriate when:

- You’re already behind on payments

- Traditional debt relief options won’t work due to high DTI

- You want to avoid bankruptcy

- You have some funds available for lump-sum settlements

Relief Strategies specializes in helping people at this stage, negotiating with creditors to reduce total debt amounts and create realistic payment plans that actually fit your budget.

Bankruptcy: While it should be a last resort, bankruptcy may be the right choice when:

- You have no realistic path to paying off debt within 5 years

- You’re facing foreclosure or repossession

- Debt settlement hasn’t worked or isn’t appropriate for your situation

- You need immediate legal protection from creditors

Chapter 7 bankruptcy can eliminate most unsecured debt within 4-6 months, though it will remain on your credit report for 10 years. Chapter 13 creates a court-supervised repayment plan lasting 3-5 years and remains on your credit report for 7 years.

The key difference between debt settlement and bankruptcy, according to Consolidated Credit, is that settlement allows you to avoid bankruptcy’s severe credit impact while still achieving significant debt reduction. However, bankruptcy provides stronger legal protections and may be necessary in the most severe situations.

Take Action: What to Do Next

Knowledge without action changes nothing. Now that you understand your DTI and what it means, here’s what to do:

First: If you haven’t already, calculate your actual DTI right now. Be honest with yourself about the numbers.

Second: Based on your DTI range, choose the appropriate solution from the recommendations above. Don’t wait for things to get worse.

Third: If your DTI is 44% or higher, reach out for professional help today. The earlier you act, the more options you have.

Remember: Your DTI isn’t a permanent sentence. It’s a snapshot of your current situation. With the right approach, you can improve it, reduce your stress, and build toward real financial stability.

The hardest part is facing the numbers honestly and taking that first step. But that’s exactly what separates people who get trapped in debt from people who break free.

Conclusion

Your debt-to-income ratio is more than just a number lenders use to qualify you for loans. It’s a financial vital sign that tells you whether you’re on solid ground or heading for trouble.

The good news? No matter what your DTI reveals, solutions exist at every level. Whether you need to optimize your already-strong financial position, get aggressive about debt payoff, or seek professional help to restructure overwhelming debt, there’s a path forward.

The difference between people who overcome debt and people who drown in it isn’t intelligence or willpower. It’s awareness and action. Now you have the awareness. The question is: what action will you take?

Need Help?

If your DTI revealed that you’re in the high-risk or critical zone, Relief Strategies can help. We specialize in debt settlement solutions that reduce your total debt burden and create realistic payment plans that actually work for your budget.

Visit ReliefStrategies.com or contact us at (888) 870-7922 for a free consultation.

We understand how quickly debt can become overwhelming, and we’re here to help you find a path back to financial stability.

About the Author

James Farias is the CEO of Relief Strategies, LLC, a firm dedicated to helping individuals achieve financial freedom through effective debt relief solutions. With over 30 years of business leadership experience and a deep passion for empowering others, James has guided many clients through the process of reducing debt and regaining control of their finances.

He understands how quickly debt can overwhelm even disciplined individuals and focuses on strategies that lower monthly payments, relieve financial stress, and create opportunities for a more secure future. Connect with James on LinkedIn or visit Relief Strategies to learn more about how he and his team can help you build financial confidence.

References

Bank of America. (2025). What is debt-to-income ratio? Better Money Habits. Retrieved from https://bettermoneyhabits.bankofamerica.com/en/credit/what-is-debt-to-income-ratio

Bankrate. (n.d.). Debt to income ratio calculator. Retrieved January 6, 2026, from https://www.bankrate.com/mortgages/ratio-debt-calculator/

CBS News. (2024, June 26). 10 signs your credit card debt is out of control. Retrieved from https://www.cbsnews.com/news/signs-your-credit-card-debt-is-out-of-control/

CBS News. (2025, March 11). 3 signs your credit card debt is overwhelming you, according to experts. Retrieved from https://www.cbsnews.com/news/signs-your-credit-card-debt-is-overwhelming-you-according-to-experts/

Consolidated Credit. (2025, December 3). Debt settlement vs debt consolidation. Retrieved from https://www.consolidatedcredit.org/debt-solutions/debt-settlement-vs-debt-consolidation/

Consumer Financial Protection Bureau. (n.d.). What is a debt-to-income ratio? Retrieved January 6, 2026, from https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-en-1791/

Credit.org. (n.d.). 10 warning signs you have debt problems. Retrieved January 6, 2026, from https://credit.org/financial-blogs/10-warning-signs-you-have-debt-problems

Experian. (2024, October 30). What is debt-to-income ratio? Retrieved from https://www.experian.com/blogs/ask-experian/credit-education/debt-to-income-ratio/

InCharge Debt Solutions. (2025, April 22). Do I have a debt problem? 15 debt warning signs. Retrieved from https://www.incharge.org/debt-relief/debt-management/do-i-have-a-debt-problem/

Wells Fargo. (n.d.). Understanding debt-to-income ratio: Calculate your DTI ratio. Retrieved January 6, 2026, from https://www.wellsfargo.com/goals-credit/smarter-credit/credit-101/debt-to-income-ratio/

Wells Fargo. (n.d.). What is a good debt-to-income ratio? Retrieved January 6, 2026, from https://www.wellsfargo.com/goals-credit/smarter-credit/credit-101/debt-to-income-ratio/understanding-dti/