Learn how debt settlement can help you regain control of your finances and reduce your debt efficiently.

Debt Settlement FAQ

- Flexible Enrollment Options

- Proven Debt Solutions

- Fast Financial Relief

Debt settlement is an effective way to address overwhelming financial challenges. At Relief Strategies, we help you navigate this process with expert guidance, providing answers to your most pressing questions. Below, you’ll find everything you need to know about how debt settlement works, its benefits, and what you can expect from our program. Need more details? Feel free to reach out to us!

Key Program Highlights

Debt Reduction

Negotiate reduced balances to make your debt more manageable.

Professional Guidance

Work with trusted professionals every step of the way.

Tailored Plans

Receive customized solutions based on your unique financial situation.

Program Basics:

-

What types of debt relief are available?

Common debt relief options include simply making minimum payments, which can preserve your credit score short-term but may take decades and add extensive interest costs; credit counseling, which can lower interest rates and protect your credit but doesn’t reduce the principal owed and often takes years to complete; debt settlement, which temporarily affects your credit but can lower the total amount you owe and potentially improve your financial position within a few years; and bankruptcy, a last-resort option that can eliminate or restructure certain debts but generally impacts your credit for up to a decade and may involve lengthy repayment plans similar to settlement.

-

What kind of debt resolution options do you offer?

We primarily offer debt settlement—where we negotiate with creditors to reduce the amount owed and help you clear debts more quickly at a reduced cost, though this can initially affect your credit—and federally approved student loan relief programs, which provide manageable payments, potential loan forgiveness, and no direct credit penalty. If you’re unsure which option suits your situation best, we’re here to help you understand the differences and guide you toward a solution aligned with your financial goals.

-

What is debt settlement?

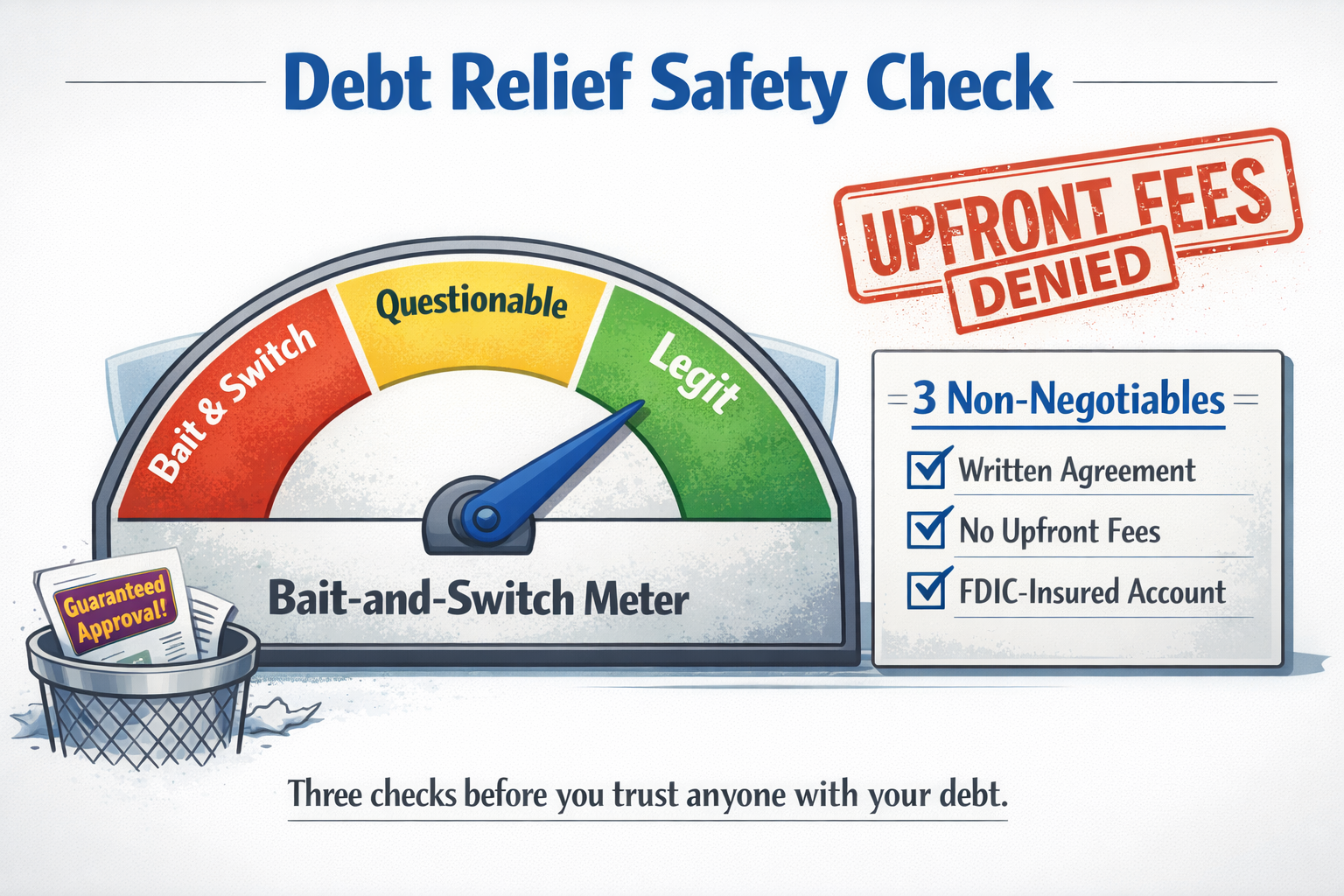

Debt settlement is a program that is designed to help individuals reduce their principal debt, fees and interest by negotiating settlements with creditors. It allows participants to make one monthly deposit into an FDIC-insured account, which is used to settle debts over time. This program typically resolves debt significantly faster and for less money than making minimum payments.

-

Who qualifies for debt settlement?

Generally, you’ll need at least $15,000 in unsecured debt—such as credit cards, personal loans, or medical bills—and be experiencing a financial hardship (e.g., job loss, divorce, or medical challenges). Debt settlement is most effective if you’re struggling to meet minimum monthly payments and don’t see a clear path to paying off your debt within a reasonable timeframe. While not everyone qualifies, speaking with a representative can help determine if this option aligns with your financial situation and goals.

-

What debts are eligible for debt settlement?

Generally, unsecured debts can be settled, including credit card balances, personal loans, payday loans, medical bills, and auto loans with deficiency balances, as well as certain business debts from closed entities without collateral.

-

Can I cancel the program at any time?

Yes. The program is entirely voluntary, and you’re free to withdraw at any point. Because you maintain control of the funds in your dedicated, FDIC-insured account, you can stop participating without losing what you’ve already saved, minus any applicable start-up or maintenance fees. If you decide to exit, we’ll help you understand your remaining options so you can make an informed decision about the next steps in managing your debt.

-

Is your debt settlement program available in all 50 states?

Currently, our debt settlement program is NOT available in 5 states, in Alaska, Rhode Island, Vermont, West Virginia, or Oregon. This is often due to state-specific regulatory requirements or licensing restrictions. If you reside in one of these states, we recommend exploring other accredited debt relief services or consulting a licensed professional who can help navigate the options available in your area.

Mon-Fri 8AM-5PM PST

(888) 870-7922

Program Duration, Fees, and Deposits:

-

How long does the program take?

The duration of the program typically ranges from 24 to 60 months, depending on the total debt enrolled and your monthly deposit amount. Clients can complete the program faster if they increase their deposits.

-

What fees are involved in the program?

Fees for the program are calculated based on the total debt enrolled. These fees are deducted from the settlement amounts once a settlement is reached. No fees are charged until a settlement has been negotiated and approved by the client.

-

How are the fees handled during settlement?

All your program deposits are maintained in a dedicated, FDIC-insured account held with Global. When a settlement is reached and approved by you, the agreed-upon settlement amount and the associated service fees are deducted from this account. If you choose not to proceed with a proposed settlement or decide to exit the program entirely, your remaining funds will be returned to you, minus any applicable start-up or maintenance fees as outlined in your initial agreement.

-

Can I modify my account or deposits?

Yes, you may adjust your deposit schedule if your financial situation changes. Keep in mind that reducing or skipping deposits can delay the settlement process and extend the total time to complete the program. Before making any changes, consider speaking with a representative who can help you find a new deposit schedule that balances flexibility with the need to resolve your debts as efficiently as possible.

-

What happens if creditors call me during the program?

It’s common to receive calls from creditors during the early stages of the program. If contacted, calmly explain that you’re experiencing financial hardship and that you’re enrolled in a professional debt resolution program. Avoid discussing settlement terms or making new payment arrangements on your own; simply refer the creditor to your legal team, who will handle all negotiations. Over time, as settlements are reached, these calls typically decrease.

Impact on Credit and Taxation:

-

How will my credit be affected by a debt settlement program?

Participating in a debt settlement program may lower your credit score initially, as it often requires pausing regular payments to creditors while negotiations occur. However, the program aims to reduce your overall debt, putting you in a better position to rebuild your financial health once settlements are completed. To support credit recovery, maintain consistent, on-time deposits to your dedicated account, monitor your credit reports for inaccuracies, and consider opening a secured credit card to build positive payment history by keeping balances low and making timely payments. These steps can help steadily improve your credit profile over time.

-

Are there any tax implications for forgiven debt?

Forgiven debt over $600 may generally be considered taxable income by the IRS, and you could receive a 1099-C form from the creditor reporting that amount. However, if at the time of settlement you are deemed insolvent—meaning your total liabilities exceed the value of your assets—you may be eligible for tax relief by filing IRS Form 982. Other exceptions and exclusions may also apply depending on your individual circumstances, so it’s often wise to consult a qualified tax professional to understand your options fully.

Legal and Negotiation Process:

-

What happens if I have a lawsuit or legal action against me?

If you have an account with legal action already in progress, Countrywide Legal Group can provide litigation defense for an additional fee. However, this coverage must be added before enrolling the account. If litigation begins after enrollment, the legal team will work to negotiate the debt.

-

What is the role of Countrywide Legal Group in the program?

In states that operate under the Attorney Model, Countrywide Legal Group provides debt negotiation services directly. They ensure that any settlements are legally sound and that clients are protected from aggressive collection tactics.

-

How does the negotiation process work?

After you’ve made several months of deposits into your dedicated, FDIC-insured account, and sufficient funds have accumulated, Countrywide Legal Group (or an authorized legal representative in Attorney Model States) begins contacting your creditors to negotiate a reduced payoff amount. Each proposed settlement is presented to you for approval, ensuring you remain in control of the process. Once you approve, the agreed amount is paid from your dedicated account. This process repeats until all of your enrolled debts are settled, typically resulting in a more manageable and cost-effective path out of debt.

-

What is the Legal Access Plan, and should I include it?

The Legal Access Plan provides attorney representation for stopping collection calls, handling difficult creditors, and representing you in legal actions related to your enrolled debts. Most clients choose to include this plan for added protection and peace of mind.

Special Situations & Clarifications:

-

My prospect’s former spouse filed bankruptcy. My prospect did not join the bankruptcy, nor file on their own, yet their credit score went down. Why might that be?

If your prospect was an authorized user, or otherwise shared any of the debts that their former spouse had discharged in bankruptcy, the entire debt can become the responsibility of the non-filing party.

-

What does the term Transferred/Sold mean on their credit report?

The term "Transferred/Sold" on a credit report, such as Experian's Xactus credit report product, indicates that the original creditor or lender has transferred or sold the account to another entity. This is a common practice, especially with debts that are considered delinquent or are not being paid as agreed.

-

My client’s maiden name is on their checking account, however, their married name is now their legal name. How would I enroll her?

If your client’s maiden name appears on their checking account as Destiney Jones, but their legal name is now Destiney Smith, you should enroll them as follows: First Name: Destiney, Last Name: Jones Smith.

Real Results, Real Change

Debt Relief Success Stories

Izzy helped me and after discussing how to get me get out of debt, I felt so much better! Thanks for the service!

Jennifer B

I can’t believe just how much this one phone call has taken off my shoulders. I dug myself into a hole with the payday loan that was going to cost me thousands and thousands of dollars for just a $4000 loan. Izzy has been a lifesaver trying to show me a better way. And I am so grateful and thankful that she was there to help me today She was knowledgeable and friendly and patient with my computer skills and I really appreciate it

Kimberly G

Izzy was very kind and patient. She explained the process in a manner that I was able to understand. Even after the entire process, I am still able to get in contact with Izzy and she will respond in a timely manner. I definitely recommend her to others. 🙂

Rosita C

My representative was Frank G. Amazing experience! I had talked to other agencies that deal with my debt challenge, never felt comfortable until I contacted Relief Strategies. I was extremely lucky to find Frank on the phone. He was understanding, considerate and compassionate. Once we talked and he gave me the facts and opinions i immediately signed for their services! He is great to work with. Give him a call

Frank B

Izzy, you are AMAZING! Your ability to help me see the BIG picture was eye opening and alarming. I was trapped, a POW to debt and I didn't even know. I praise God for you and your team of soldiers, fighting for me. Thank you 😊

Gloria G

Izzy was very personable and knowledgeable about the program and all that it offers. She made it a less stressful experience.

Sonja W

Ready to take the next step toward financial freedom?

Our team is here to help you explore your options and start your debt settlement journey. Schedule a consultation or get in touch today!

Learn & Explore

Dive into our curated content for a deeper understanding of debt relief solutions.