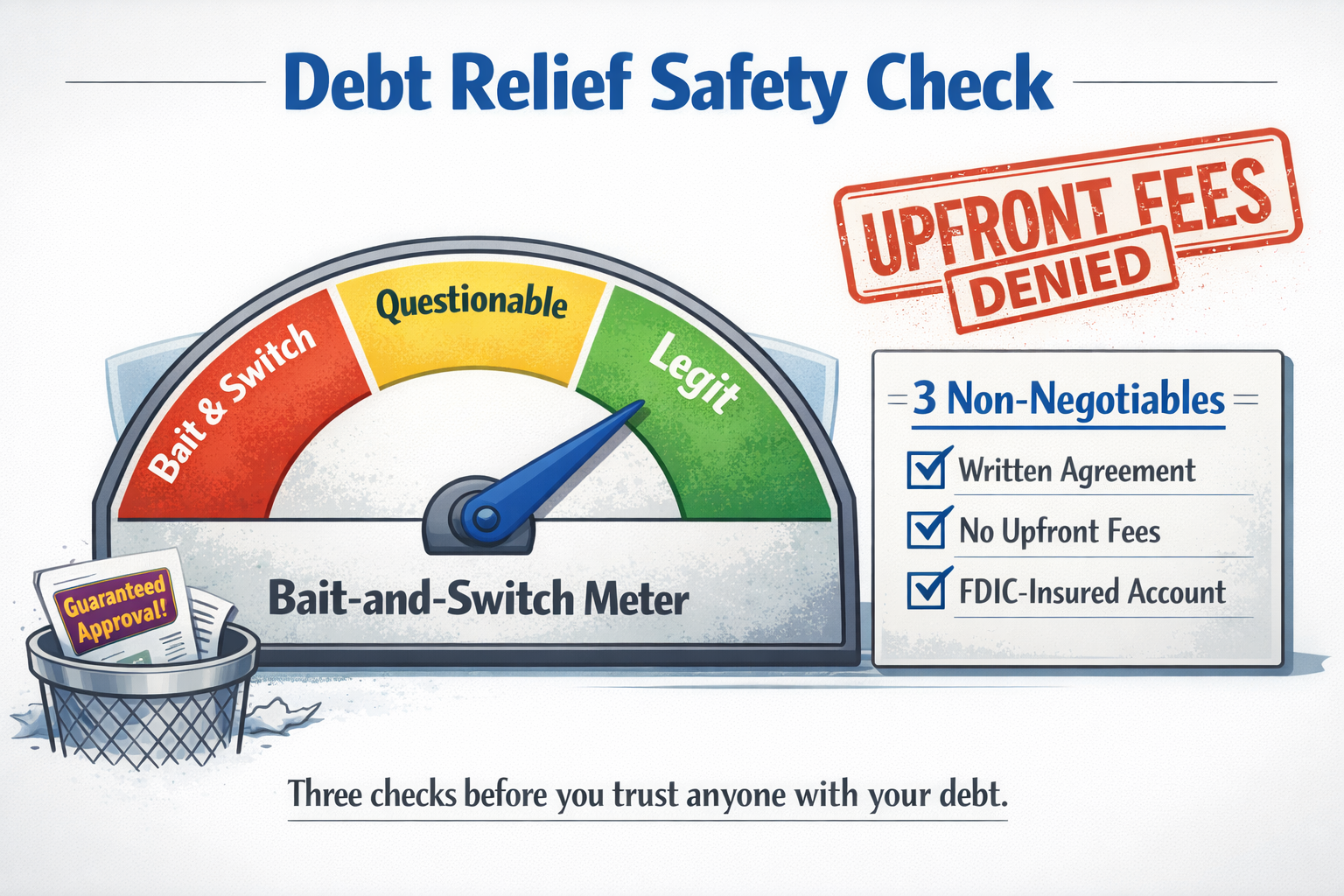

“Debt settlement is a scam” made sense 15 years ago. Today, it’s an oversimplification. Learn how the 2010 FTC rules changed the industry, three non-negotiables for identifying legitimate companies, and what really happens to your credit.

Beyond the Balance

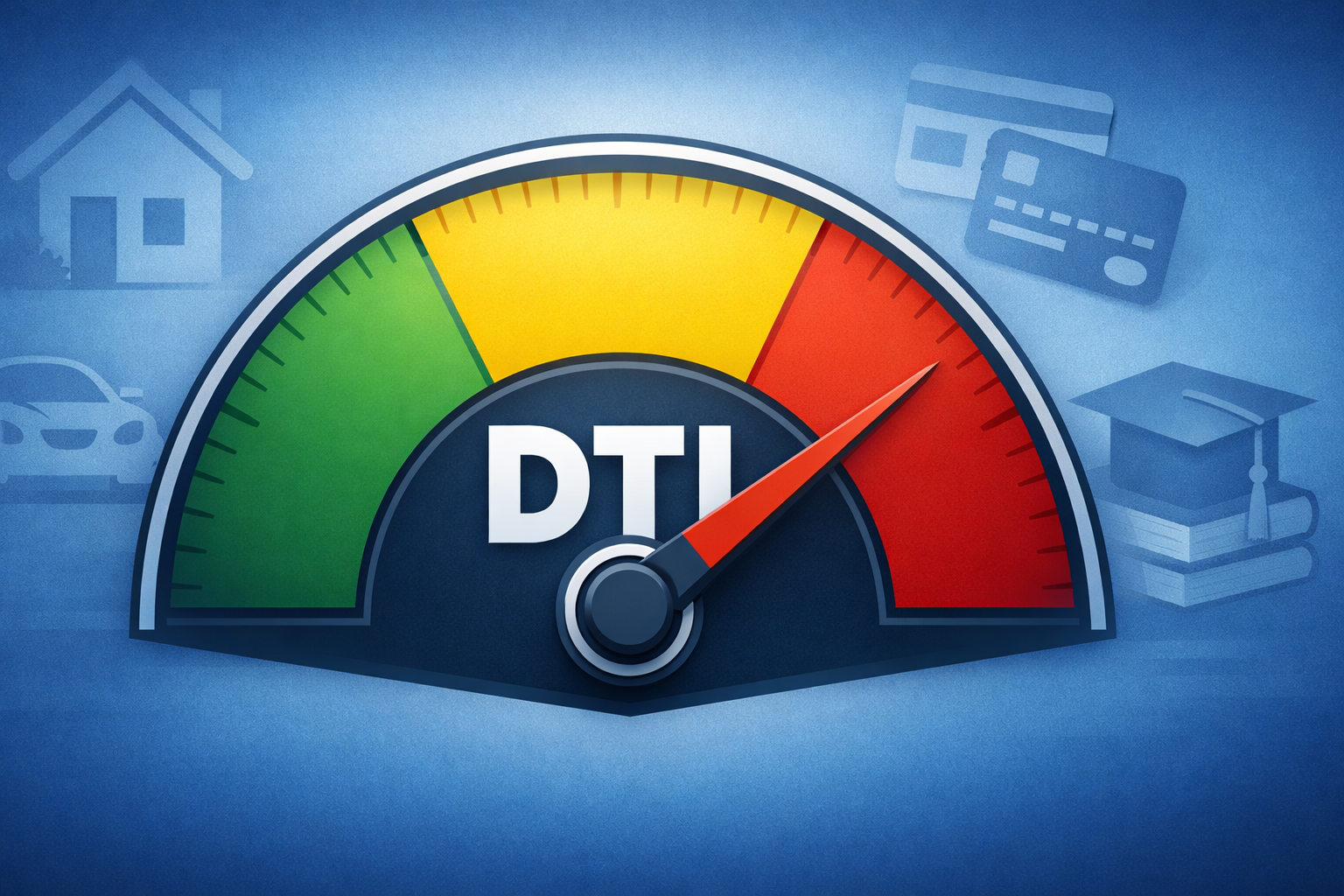

DTI is a financial vital sign. If too much of your income is already spoken for, no budget trick will fix it. Here’s how to calculate your DTI, what it means, and when it’s time to get real help.

Relief Strategies was recognized as a Best Consultant by BusinessRate for 2025, based on independent Google reviews from the people we serve. This past year was about doing the work the right way, focusing on education over pressure, stronger systems, and long-term outcomes.

The 2025 government shutdown has frozen key federal support for borrowers. Loan applications are delayed, hold times are spiking, and the risk of credit damage is rising. Here’s how to protect yourself until Washington reopens.

The average credit score just posted its sharpest single-year drop since the Great Recession. This isn’t just a statistical blip—it’s a warning sign for borrowers already under pressure.

With tariffs back in the headlines, prices are rising and so is household debt. This article breaks down what the 2025 trade wave means for your budget and what you can do to protect yourself.

Complaints about debt collection calls have more than doubled in 2025—what’s causing the spike, and what can consumers do about it? This article breaks down the numbers, the politics, and the protections you still have.

With credit card APRs nearing 25% and relief from the Fed nowhere in sight, families are facing painful choices. This article breaks down what today’s interest rates mean for your wallet, and the debt settlement strategies that might actually help.

The Senate’s “Big Beautiful Bill” is here, and it could either boost your budget or tighten the squeeze. This article breaks down the winners, losers, and what to watch as taxes, benefits, and household costs shift.

The Senate just passed the most sweeping student loan overhaul in decades. From new limits to longer forgiveness timelines, this article breaks down what it means for borrowers today and tomorrow.

Recent Posts

Tags

All Services

- Awards & Recognition

- Client Success & Debt Relief Outcomes

- Company Updates

- Consumer Alerts

- Consumer Protection & Debt Relief

- Consumer RIghts & Protections

- Credit & Debt Management

- Credit Impact

- Debt Management Strategies

- Debt Relief & Economic Policy

- Debt Relief Insights

- Debt Settlement Insights

- Economic Policy & Personal Finance

- Events

- Financial Education & Awareness

- Student Loan News

- Student Loans & Financial Aid