Learn how credit repair works, what to expect, and how improving your credit score can open new financial opportunities.

Credit Repair FAQ

- Personalized Plans

- Proven Disputes

- Ongoing Credit Support

Your credit score plays a crucial role in your financial life. Understanding how credit repair works can help you make informed decisions and take steps toward a healthier credit profile. Below, we've compiled answers to the most common credit repair questions, so you can feel confident about the process and its benefits. If you need personalized guidance, our team is here to help!

Key Program Highlights

Improved Credit Score

Removing inaccurate negative items may help increase your credit score over time.

Better Financial Opportunities

A better credit score may help you qualify for loans, lower rates, and financial stability.

Professional Guidance

Receive expert insights on credit management and long-term financial health.

General Credit Repair Questions:

-

How does credit repair work?

Credit repair is the process of identifying and disputing inaccurate or unverifiable negative items on your credit report to help improve your credit score over time.

-

How does credit repair work?

The process involves reviewing your credit report, identifying negative items, and submitting disputes to credit bureaus, creditors, or collection agencies to correct inaccuracies.

-

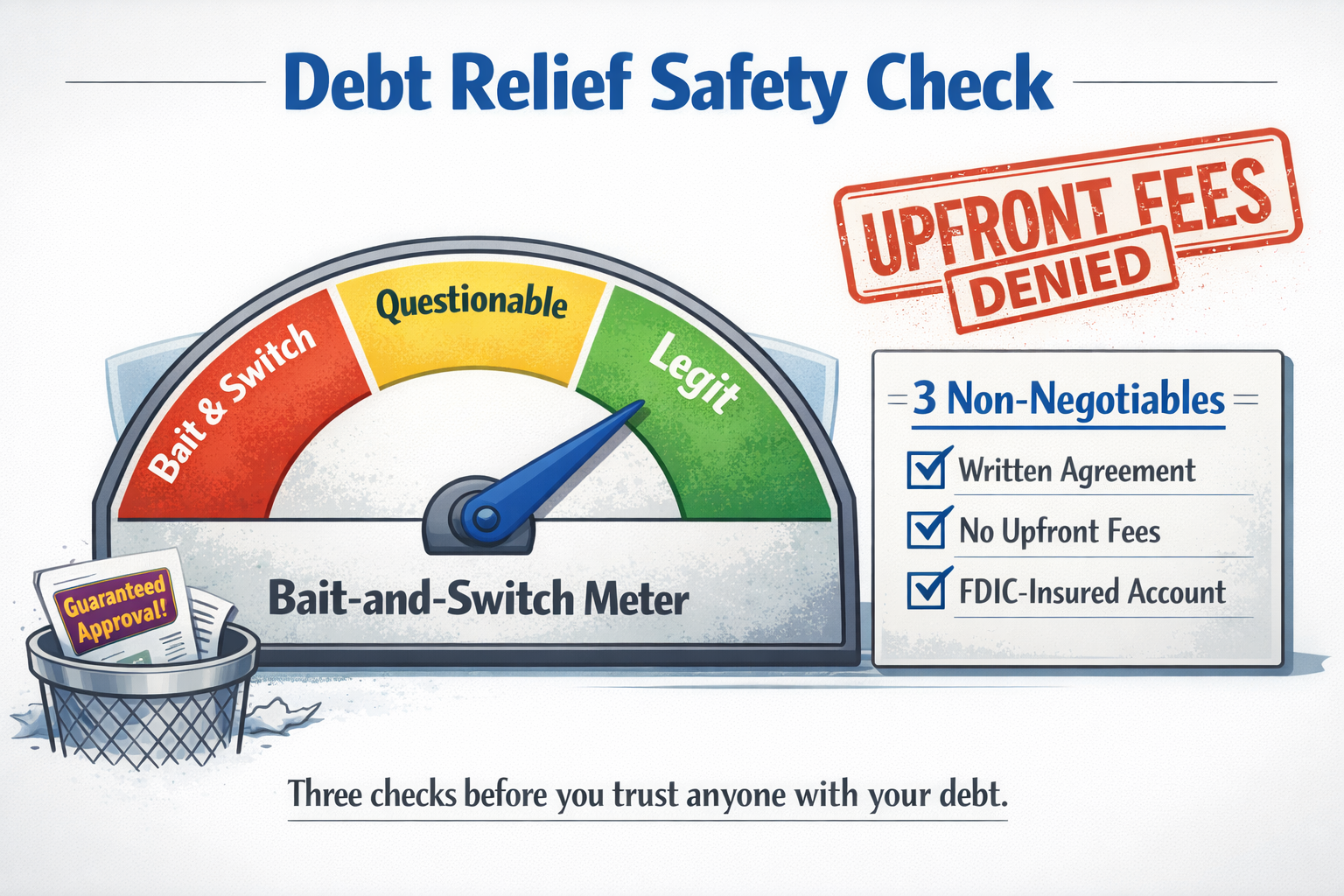

Is credit repair legal?

Yes, credit repair is legal under the Credit Repair Organizations Act (CROA), which ensures consumers are protected from fraudulent practices.

Eligibility and Enrollment:

-

Who qualifies for credit repair?

Individuals with a credit score of 640 or lower, negative items (such as late payments or collections), and stable employment may benefit from credit repair services.

-

Can I repair my credit on my own?

Yes, credit repair is legal under the Credit Repair Organizations Act (CROA), which ensures consumers are protected from fraudulent practices.

-

Does credit repair work for everyone?

Credit repair is most effective for individuals with inaccurate or unverifiable negative items on their credit report. It does not remove legitimate negative marks.

Mon-Fri 8AM-5PM PST

(888) 870-7922

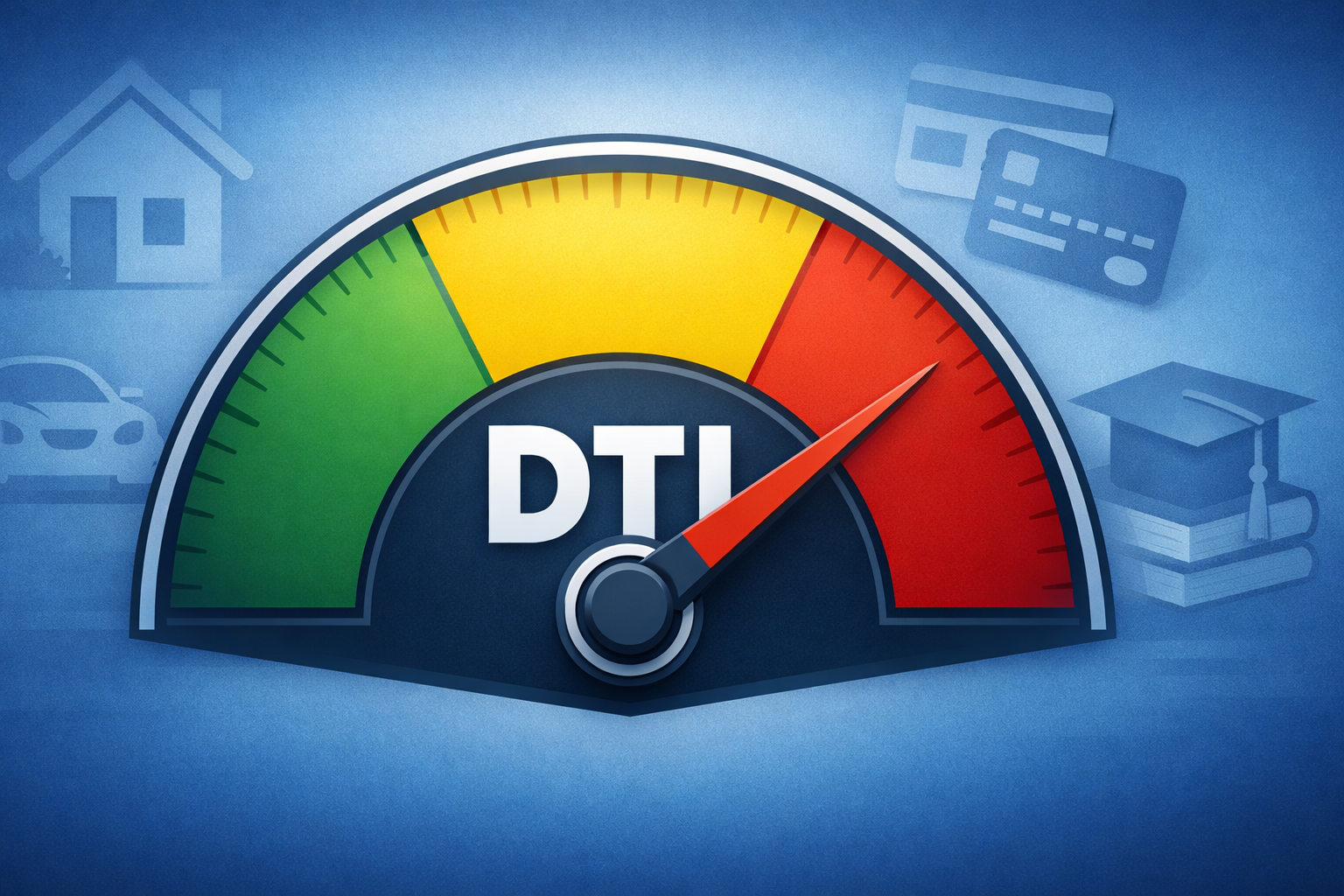

Impact on Credit:

-

Will credit repair increase my credit score?

While there’s no guaranteed score increase, removing inaccurate negative items may help improve your credit score over time.

-

How soon can I expect to see results?

Some clients notice changes within 30–90 days, but it can take several months to fully resolve disputes. While there’s no guarantee, the timeline depends on their credit profile and how items are addressed on their report.

-

Can credit repair help me qualify for a loan or mortgage?

Improving your credit score through credit repair may make it easier to qualify for loans, credit cards, or mortgages with better interest rates.

Costs & Payment:

-

How much does credit repair cost?

Pricing varies depending on the service package selected. Some providers charge an initial enrollment fee plus a monthly service fee.

-

Are there any hidden fees? No, all costs should be clea

No, all costs should be clearly disclosed before you enroll in any credit repair program.

Process & Timeframe

-

How often will I receive updates on my progress?

Clients typically receive regular updates on dispute status, credit changes, and improvements.

-

What happens if an item cannot be removed?

If an item is verified as accurate, it will remain on your credit report until it naturally falls off based on credit bureau guidelines.

Other Credit-Related Concerns

-

Does credit repair help with identity theft issues?

Yes, credit repair services can assist in disputing fraudulent accounts that appear on your credit report due to identity theft.

-

Can credit repair stop debt collectors from contacting me?

No, credit repair does not prevent creditors or collection agencies from contacting you, but certain legal protections may apply.

See How Others Improved Their Situation

Real Success Stories

Izzy helped me and after discussing how to get me get out of debt, I felt so much better! Thanks for the service!

Jennifer B

I can’t believe just how much this one phone call has taken off my shoulders. I dug myself into a hole with the payday loan that was going to cost me thousands and thousands of dollars for just a $4000 loan. Izzy has been a lifesaver trying to show me a better way. And I am so grateful and thankful that she was there to help me today She was knowledgeable and friendly and patient with my computer skills and I really appreciate it

Kimberly G

Izzy was very kind and patient. She explained the process in a manner that I was able to understand. Even after the entire process, I am still able to get in contact with Izzy and she will respond in a timely manner. I definitely recommend her to others. 🙂

Rosita C

My representative was Frank G. Amazing experience! I had talked to other agencies that deal with my debt challenge, never felt comfortable until I contacted Relief Strategies. I was extremely lucky to find Frank on the phone. He was understanding, considerate and compassionate. Once we talked and he gave me the facts and opinions i immediately signed for their services! He is great to work with. Give him a call

Frank B

Izzy, you are AMAZING! Your ability to help me see the BIG picture was eye opening and alarming. I was trapped, a POW to debt and I didn't even know. I praise God for you and your team of soldiers, fighting for me. Thank you 😊

Gloria G

Izzy was very personable and knowledgeable about the program and all that it offers. She made it a less stressful experience.

Sonja W

Ready to Improve Your Financial Future?

Our team is here to help you navigate the credit repair process and explore your options. Schedule a consultation today and start your journey to financial improvement!

Learn & Explore

Dive into our curated content for a deeper understanding of debt relief solutions.