Helping you find relief from overwheliming medical expenses and regain financial stability

Medical Debt Relief Services

- Reduce Medical Balances

- Manageable Payment Plans

- Peace of Mind

What is Medical Debt Settlement?

Medical debt settlement is a crucial financial relief process that involves negotiating with healthcare providers or collection agencies to reduce the amounts owed by patients. This negotiation is often necessary for individuals faced with substantial medical bills that were unexpected and are beyond their financial capability. By engaging in debt settlement, patients can significantly alleviate the financial burden imposed by these expenses. This process not only helps to manage and reduce debt but also aims to restore financial stability to individuals, allowing them to focus on recovery without the looming stress of insurmountable medical bills.

How Medical Debt Settlement Works

Initial Contact and Assessment

We assess your financial situation, review the specifics of your medical debts, and identify the most effective relief options tailored to your needs.

Learn MoreSaving and Debt Negotiation

Build the necessary funds for settlement as our team negotiates with healthcare providers to reduce your medical debt and create a personalized resolution plan.

Learn MorePayment and Resolution

Once an agreement is reached, you make a single, reduced payment to fully and completely resolve your outstanding medical debt obligations.

Learn MoreBenefits of Medical Debt Settlement

Reduced Balances

Significantly reduce the balances you owe, making your debt more manageable and achievable.

One Monthly Deposit

Make one low monthly program deposit while working toward freedom from medical debt.

Faster Resolution

Resolve your debts within 24-48 months, offering a quicker alternative to long-term repayment plans.

Who Qualifies?

-

Common Qualifying Factors

Debt settlement can be a lifeline for individuals facing financial hardship, often caused by reduced income, unexpected expenses, or mounting medical bills. This solution is typically available for unsecured debts such as credit card balances, personal loans, and medical debts. While most programs require a minimum of $6,000 in eligible debt to qualify, cases with over $15,000 in debt tend to achieve the most significant results. Understanding these criteria is essential for determining if debt settlement is the right step toward regaining financial stability.

-

What’s Not Eligible

Debt settlement is generally not an option for secured debts, such as mortgages, auto loans, and home equity lines of credit, as these debts are tied to collateral. Similarly, student loans are usually excluded unless specifically negotiated under unique circumstances. Additionally, recent debts—those less than three months old—are often not eligible for settlement, as creditors typically wait longer before considering such negotiations. Understanding these limitations is critical when evaluating whether debt settlement aligns with your financial situation.

-

Legal and Financial Considerations

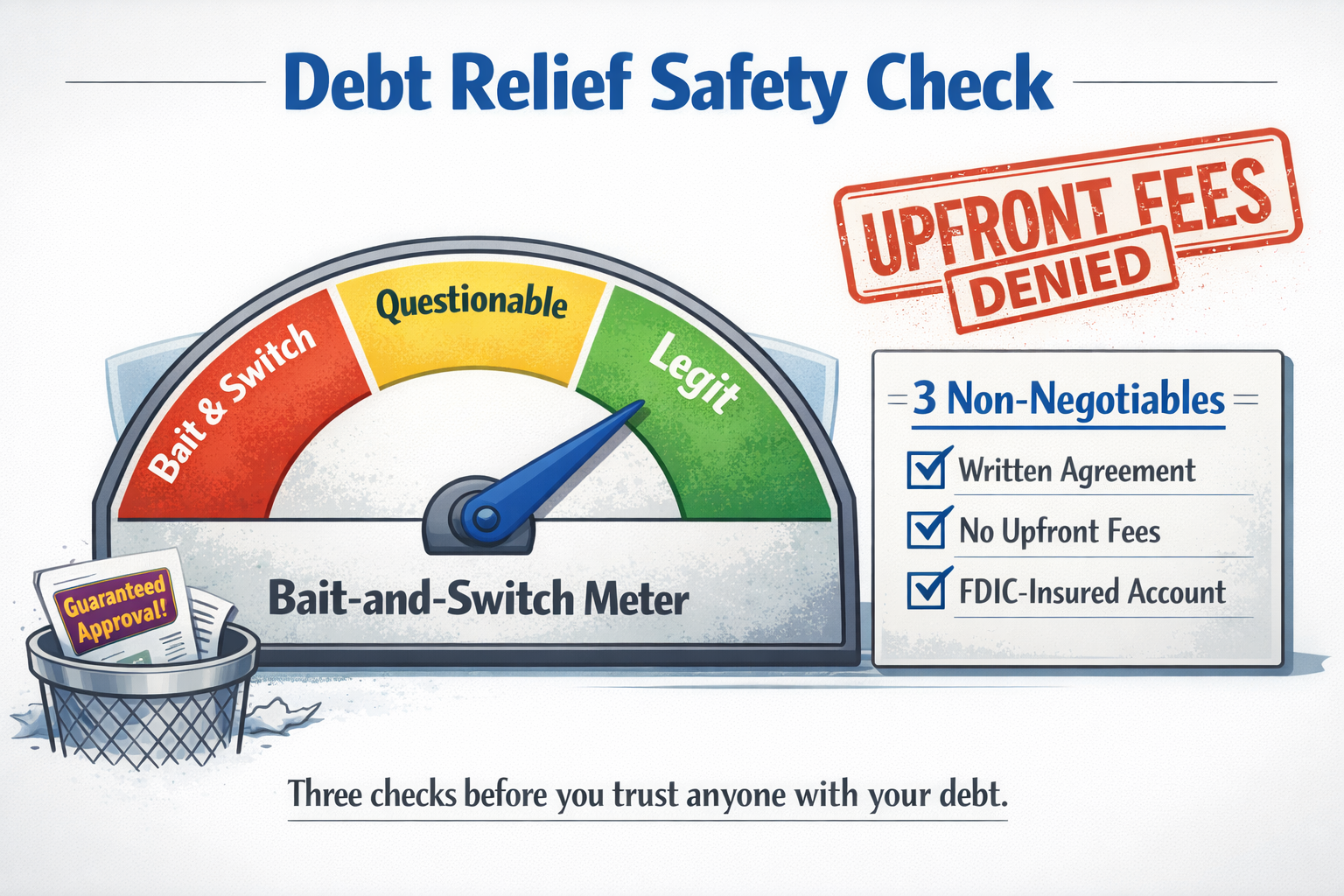

Debt settlement can have several implications to consider. The process often impacts your credit score both during and after negotiations, which can take time to recover. While negotiations are ongoing, there is also a risk of collection actions or lawsuits from creditors. Additionally, any forgiven debt may be considered taxable income by the IRS, potentially adding to your financial responsibilities. To navigate these challenges effectively and safely, it's crucial to work with a reputable debt settlement company to avoid scams and ensure a smooth process.

-

Is Debt Settlement Right for You?

To fully understand the debt settlement process and what to expect along the way, it’s important to explore the steps involved. Relief Strategies is dedicated to guiding you through every stage, providing clarity and support as you navigate your debt relief options. With expert assistance, you can move toward financial freedom with confidence and peace of mind.

How We’ve Helped Others Overcome Debt

Stories of Relief

Izzy helped me and after discussing how to get me get out of debt, I felt so much better! Thanks for the service!

Jennifer B

I can’t believe just how much this one phone call has taken off my shoulders. I dug myself into a hole with the payday loan that was going to cost me thousands and thousands of dollars for just a $4000 loan. Izzy has been a lifesaver trying to show me a better way. And I am so grateful and thankful that she was there to help me today She was knowledgeable and friendly and patient with my computer skills and I really appreciate it

Kimberly G

Izzy was very kind and patient. She explained the process in a manner that I was able to understand. Even after the entire process, I am still able to get in contact with Izzy and she will respond in a timely manner. I definitely recommend her to others. 🙂

Rosita C

My representative was Frank G. Amazing experience! I had talked to other agencies that deal with my debt challenge, never felt comfortable until I contacted Relief Strategies. I was extremely lucky to find Frank on the phone. He was understanding, considerate and compassionate. Once we talked and he gave me the facts and opinions i immediately signed for their services! He is great to work with. Give him a call

Frank B

Izzy, you are AMAZING! Your ability to help me see the BIG picture was eye opening and alarming. I was trapped, a POW to debt and I didn't even know. I praise God for you and your team of soldiers, fighting for me. Thank you 😊

Gloria G

Izzy was very personable and knowledgeable about the program and all that it offers. She made it a less stressful experience.

Sonja W

Medical Debt Services F.A.Q.s

-

Can medical debt settlement stop collection calls?

Yes, medical debt settlement can often stop collection calls. Once a settlement agreement is negotiated and accepted by your creditors, collection efforts should cease. It's essential to communicate openly with your debt settlement agency to ensure all relevant creditors are informed of the arrangement.

-

How long does it take to settle medical debt?

The time it takes to settle medical debt can vary depending on several factors, including the total amount of debt and the willingness of creditors to negotiate. On average, debt settlement processes can take anywhere from a few months to a few years. Working with a professional debt settlement service can often expedite this process.

-

How will settling a medical debt affect my score answer?

Debt settlement can have several implications to consider. The process often impacts your credit score both during and after negotiations, which can take time to recover. While negotiations are ongoing, there is also a risk of collection actions or lawsuits from creditors. Additionally, any forgiven debt may be considered taxable income by the IRS, potentially adding to your financial responsibilities. To navigate these challenges effectively and safely, it's crucial to work with a reputable debt settlement company to avoid scams and ensure a smooth process.

For more detailed information on how settling your medical debt can impact your credit and other frequently asked questions, visit our Debt Settlement FAQ page.

Ready to Take the Next Step?

Schedule an appointment or request more information to start your journey toward debt relief today.

Further Insights into Debt Settlement

Explore our comprehensive articles to understand your options and make informed decisions.