Help your team reduce financial stress and focus on success.

Debt Relief as a Strategic Employee Benefit

- Flexible Enrollment Options

- Proven Debt Solutions

- Fast Financial Relief

Why Offer Debt Relief Benefits?

Financial stress affects productivity, well-being, and overall job satisfaction, making it a leading cause of employee distraction and turnover. By providing debt relief solutions, you’re not only addressing a critical source of stress but also empowering your team to regain control of their finances. This investment in your employees’ financial health fosters loyalty, increases focus, and enhances their ability to perform at their best—benefiting both your workforce and your organization’s bottom line.

Key Benefits

Increased Productivity

Employees free from financial stress are more focused, engaged, and productive.

Enhanced Retention

Offering unique and meaningful benefits helps attract, retain, and inspire top talent.

Ongoing Employee Support

Our team provides continuous support to ensure your employees’ success.

How It Works

Consult with Our Team: Design a program that fits your company’s needs.

Enroll Employees: Simplify the process with minimal paperwork and easy registration.

Track Progress: Receive regular reports on employee engagement and program success

Frequently Asked Questions

-

Why should we offer debt relief as an employee benefit?

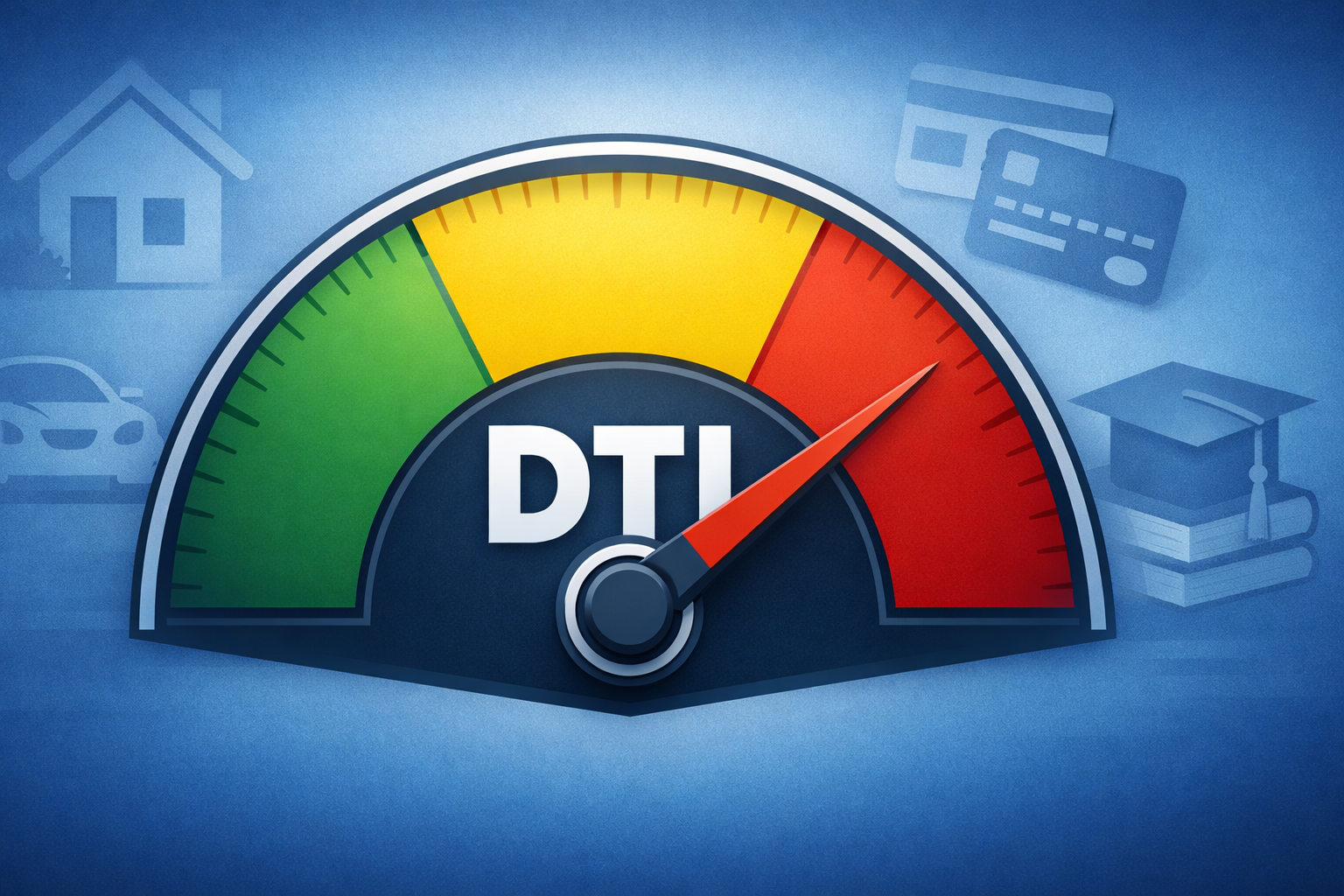

Financial stress impacts productivity, satisfaction, and retention. Employees experiencing financial strain are 2.5 times more likely to be distracted and twice as likely to seek new employment. Debt relief benefits support wellness, boost retention, and improve morale without adding costs.

-

How do debt relief benefits improve employee retention and productivity?

Reducing financial stress allows employees to focus on their work. Studies show financially stressed employees are less productive and more likely to leave, while benefits like these foster loyalty and engagement.

-

What types of debt relief programs are available?

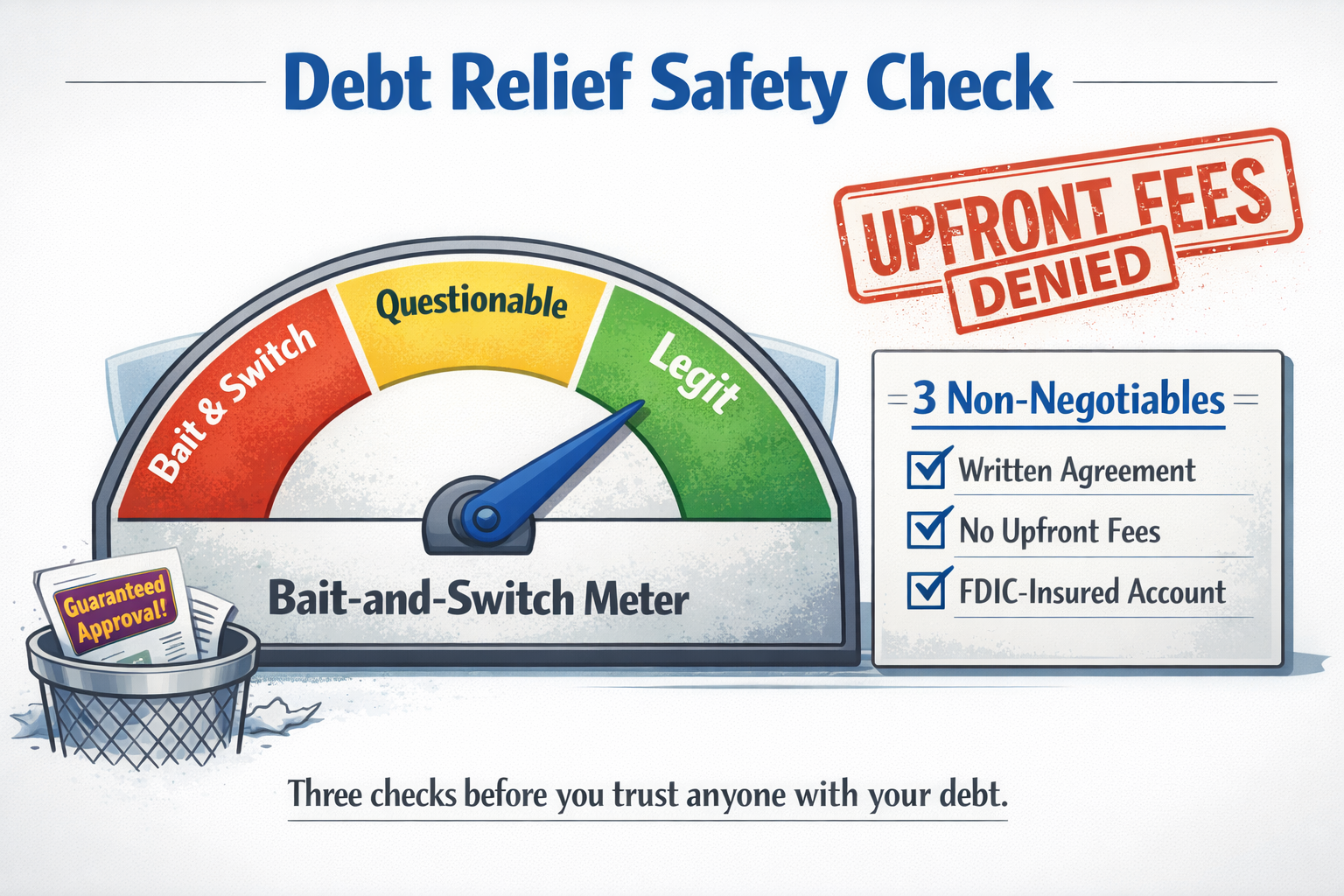

Relief Strategies offers federal student loan relief programs and debt settlement options for credit card, medical, and other unsecured debts.

-

How does the program work for employees?

Employees opt in voluntarily and enroll through a direct link or integrated portal. They cover their own program costs, ensuring no financial burden for the employer.

-

Does this program cost the employer anything?

No. The program is a voluntary benefit. Employers can also earn a referral fee on gross enrolled debt.

-

What results have employees seen from these programs?

People have achieved significant savings. For example, one couple reduced their student loan debt from $275,000 to $23,000, saving $1,741 monthly. Another client saved $570 monthly on credit card payments.

-

What are the steps to implement this benefit?

Implementing this benefit is simple and seamless. Start by contacting us for a free consultation to discuss your organization’s needs and goals. Next, choose the enrollment method that works best for your team, whether it’s through a direct registration link or integration into your existing employee portal. Once set up, we’ll help onboard employees with informational sessions and provide ongoing support to ensure a smooth experience. As employees enroll, your organization will also earn a referral incentive, making this a win-win for both your team and your business.

-

How do we get started?

Schedule a consultation by emailing contactus@reliefstrategies.com or calling (888) 870-7922. We’ll guide you through the process.

Want to learn more? Explore our full Employee Benefits Program FAQ.